|

Burn Rate

Burn rate is the rate at which a company is losing money. It is typically expressed in monthly terms. E.g., "the company's burn rate is currently $65,000 per month." In this sense, the word "burn" is a synonymous term for negative cash flow. It is also a measure of how fast a company will use up its shareholder capital.Ehrenberg, David"Is Your Company Dangerously Rushing To Scale?"''Forbes.com'' January 4, 2013. Retrieved on May 20, 2014. If the shareholder capital is exhausted, the company will either have to start making a profit, find additional funding, or close down. Burn rate can also refer to how quickly individuals spend their money, particularly their discretionary income. For example, Mackenzie Investments commissioned a test to gauge the spending and saving behavior of Canadians to determine if they are “Overspenders.” Burn rate is also used in project management to determine the rate at which hours (allocated to a project) are being used, to identify when work ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow

A cash flow is a real or virtual movement of money: *a cash flow in its narrow sense is a payment (in a currency), especially from one central bank account to another; the term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain and therefore need to be forecast with cash flows; *a cash flow is determined by its time ''t'', nominal amount ''N'', currency ''CCY'' and account ''A''; symbolically ''CF'' = ''CF''(''t,N,CCY,A''). * it is however popular to use ''cash flow'' in a less specified sense describing (symbolic) payments into or out of a business, project, or financial product. Cash flows are narrowly interconnected with the concepts of value, ''interest rate'' and liquidity. A cash flow that shall happen on a future day ''t''N can be transformed into a cash flow of the same value in ''t''0. Cash flow analysis Cash flows are often transformed into measures that give information e.g. on a company's value and situat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

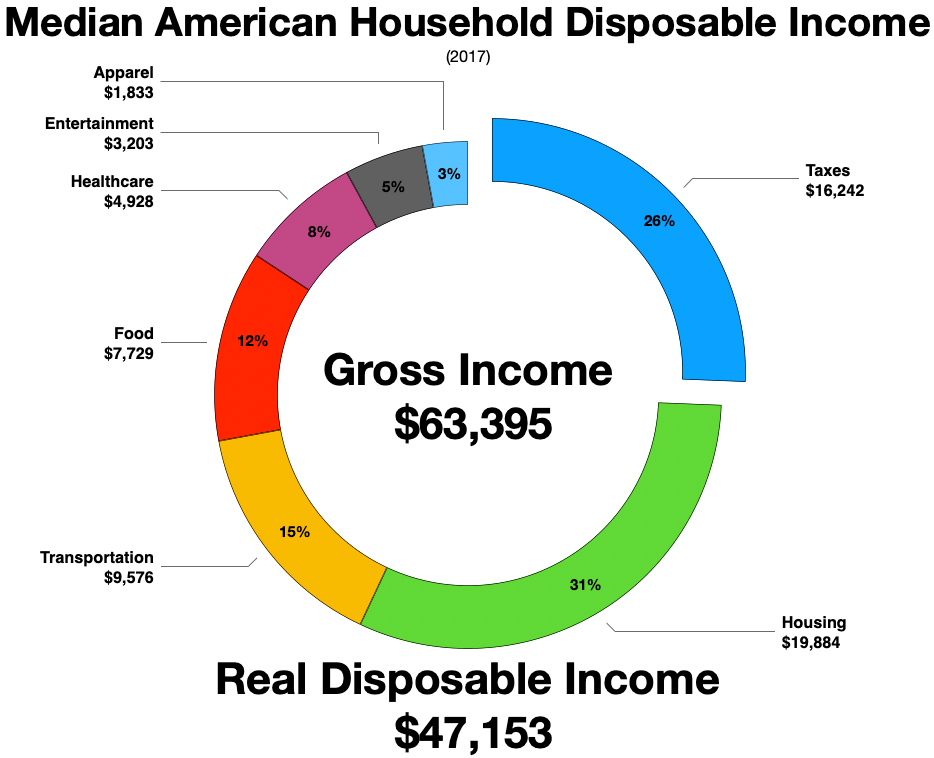

Discretionary Income

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income. Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements. The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%. For the purposes of calculating the amount of income subject to garnishments, United States' federal law defin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Project Management

Project management is the process of leading the work of a team to achieve all project goals within the given constraints. This information is usually described in project documentation, created at the beginning of the development process. The primary constraints are scope, time, and budget. The secondary challenge is to optimize the allocation of necessary inputs and apply them to meet pre-defined objectives. The objective of project management is to produce a complete project which complies with the client's objectives. In many cases, the objective of project management is also to shape or reform the client's brief to feasibly address the client's objectives. Once the client's objectives are clearly established, they should influence all decisions made by other people involved in the project – for example, project managers, designers, contractors, and subcontractors. Ill-defined or too tightly prescribed project management objectives are detrimental to decision-maki ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Era

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet. Between 1995 and its peak in March 2000, the Nasdaq Composite stock market index rose 400%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, such as Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Some companies that survived, such as Amazon, lost large portions of their market capitalization, with Cisco Systems alone losing 80% of its stock value. Background Historically, the dot-com boom can be seen as similar to a number of other technology-inspired booms of the past including railroads in the 1840s, automobiles in the early 20th century, radio in the 1920s, television in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ron Conway

Ronald Crawford Conway (born March 9, 1951) is an American venture capitalist and philanthropist. He has been described as one of Silicon Valley's "super angels". Early career Conway graduated from San Jose State University with a bachelor's degree in political science. Conway worked with National Semiconductor Corporation in marketing positions from 1973 to 1979, and at Altos Computer Systems as president and CEO from 1988 to 1990. He was the CEO of Personal Training Systems (PTS) from 1991 to 1995. PTS was acquired by SmartForce/SkillSoft. Investing Conway began angel investing in the mid-1990s, with investments in Marimba Systems, Red Herring magazine, and others. He raised $4 million for his first venture capital fund, called Adam Ventures, in 1997. In December 1998 he started Angel Investors LP, a venture capital firm. Within two months he had raised $30 million for its first fund, Angel Investors I. Angel Investors closed on its second fund, Angel Investors II, at the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Floodgate Fund

Floodgate Fund is a venture capital firm based in the United States created by Mike Maples Jr. and Ann Miura-Ko. It was originally named ''Maples Investments,'' but was renamed ''Floodgate Fund'' in March 2010. It is focused on investments in technology companies in Silicon Valley. Investments In March 2017, Floodgate raised $131 million for its sixth fund. In previous years, their fifth fund closed at $76 million, the fourth fund closed at $75 million and their third fund at $73.5 million. Floodgate has invested in a number of companies including Twitter, Digg, location-based services company Gowalla, professional networking service BranchOut, Chegg, Formstack, Milk Inc., TaskRabbit, self-storage marketplace SpareFoot, and seasteading platform company Blueseed. As of 2017, they've also invested in Lyft, Refinery29, LabDoor, education startup MissionU, legal discovery startup TextIQ, Okta and Rappi. Media coverage Floodgate Fund and Mike Maples have been covered in ''Tech ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stanford Entrepreneurship Corner

Stanford Technology Ventures Program (STVP) Entrepreneurship Corner (ECorner) (Formerly Educators Corner) is a free online archive of entrepreneurship resources for teaching and learning. The purpose of the project is to support and encourage faculty around the world who teach entrepreneurship to future scientists, engineers, managers, and others. The site has been developed by a team of educators, entrepreneurs, engineers and designers at the Stanford Technology Ventures Program (STVP). The project has been financially supported by Stanford University and a number of sponsors. Other collaborators in its creation include the Stanford Center for Professional Development and Stanford Video. Website content The design of the archive is based on feedback from entrepreneurship educators regarding the challenges faced when teaching entrepreneurship. Resources include video clips, podcasts, syllabi, books, conferences, and listings of entrepreneurship programs. Partners The STVP Entreprene ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Bust

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet. Between 1995 and its peak in March 2000, the Nasdaq Composite stock market index rose 400%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, such as Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Some companies that survived, such as Amazon, lost large portions of their market capitalization, with Cisco Systems alone losing 80% of its stock value. Background Historically, the dot-com boom can be seen as similar to a number of other technology-inspired booms of the past including railroads in the 1840s, automobiles in the early 20th century, radio in the 1920s, television in the 1940 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow

A cash flow is a real or virtual movement of money: *a cash flow in its narrow sense is a payment (in a currency), especially from one central bank account to another; the term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain and therefore need to be forecast with cash flows; *a cash flow is determined by its time ''t'', nominal amount ''N'', currency ''CCY'' and account ''A''; symbolically ''CF'' = ''CF''(''t,N,CCY,A''). * it is however popular to use ''cash flow'' in a less specified sense describing (symbolic) payments into or out of a business, project, or financial product. Cash flows are narrowly interconnected with the concepts of value, ''interest rate'' and liquidity. A cash flow that shall happen on a future day ''t''N can be transformed into a cash flow of the same value in ''t''0. Cash flow analysis Cash flows are often transformed into measures that give information e.g. on a company's value and situat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Terms

Business is the practice of making one's living or making money by producing or buying and selling products (such as goods and services). It is also "any activity or enterprise entered into for profit." Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business. If the business acquires debts, the creditors can go after the owner's personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company, such as a corporation or cooperative. Corporations, in contrast with sole proprietors and partnerships, are a separate legal entity and provide limited liability for their owners/members, as well as being subject to corporate tax rates. A corporation is more complicated an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_@_SXSW_2017_(33547017445).jpg)