|

Black Swan Fund

{{finance-stub ...

A Black Swan fund is an investment fund based on the black swan theory that seek to reap big rewards from sharp market downturns. They became more known after the financial crisis of 2007–2008. One example of a "Black Swan" fund is Universa, which was founded by Mark Spitznagel and advised by Nicholas Taleb. During the 2007–2008 financial crisis the fund posted returns of over 100%. In August 2015, Universa Investments made more than $1 billion in profits in one week, representing a 20% YTD return. References External links Risk mitigation at Universa Investment funds fund Fund may refer to: * Funding is the act of providing resources, usually in form of money, or other values such as effort or time, for a project, a person, a business, or any other private or public institution ** The process of soliciting and gathe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages include an ability to: * hire professional investment managers, who may offer better returns and more adequate risk management; * benefit from economies of scale, i.e., lower transaction costs; * increase the asset diversification to reduce some unsystematic risk. It remains unclear whether professional active investment managers can reliably enhance risk adjusted returns by an amount that exceeds fees and expenses of investment management. Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. The regulatory term is undertaking for collective investment in transferable securities, or short collective invest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Swan Theory

The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. The term is based on an ancient saying that presumed black swans did not exist a saying that became reinterpreted to teach a different lesson after they were discovered in Australia. The theory was developed by Nassim Nicholas Taleb, starting in 2001, to explain: # The disproportionate role of high-profile, hard-to-predict, and rare events that are beyond the realm of normal expectations in history, science, finance, and technology. # The non-computability of the probability of consequential rare events using scientific methods (owing to the very nature of small probabilities). # The psychological biases that blind people, both individually and collectively, to uncertainty and a rare event's massive role in historical affairs. Taleb's "black swan theory" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crisis Of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark Spitznagel

Mark Spitznagel (; born March 5, 1971) is an American investor and hedge fund manager. He is the founder, owner, and chief investment officer of Universa Investments, a hedge fund management firm based in Miami, Florida.Universa Investments L.P. firm website He is known as a pioneer in so-called “- hedging”Tail-Risk Hedge Pioneer Spitznagel on Safe Havens Keynote address, ''Bl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

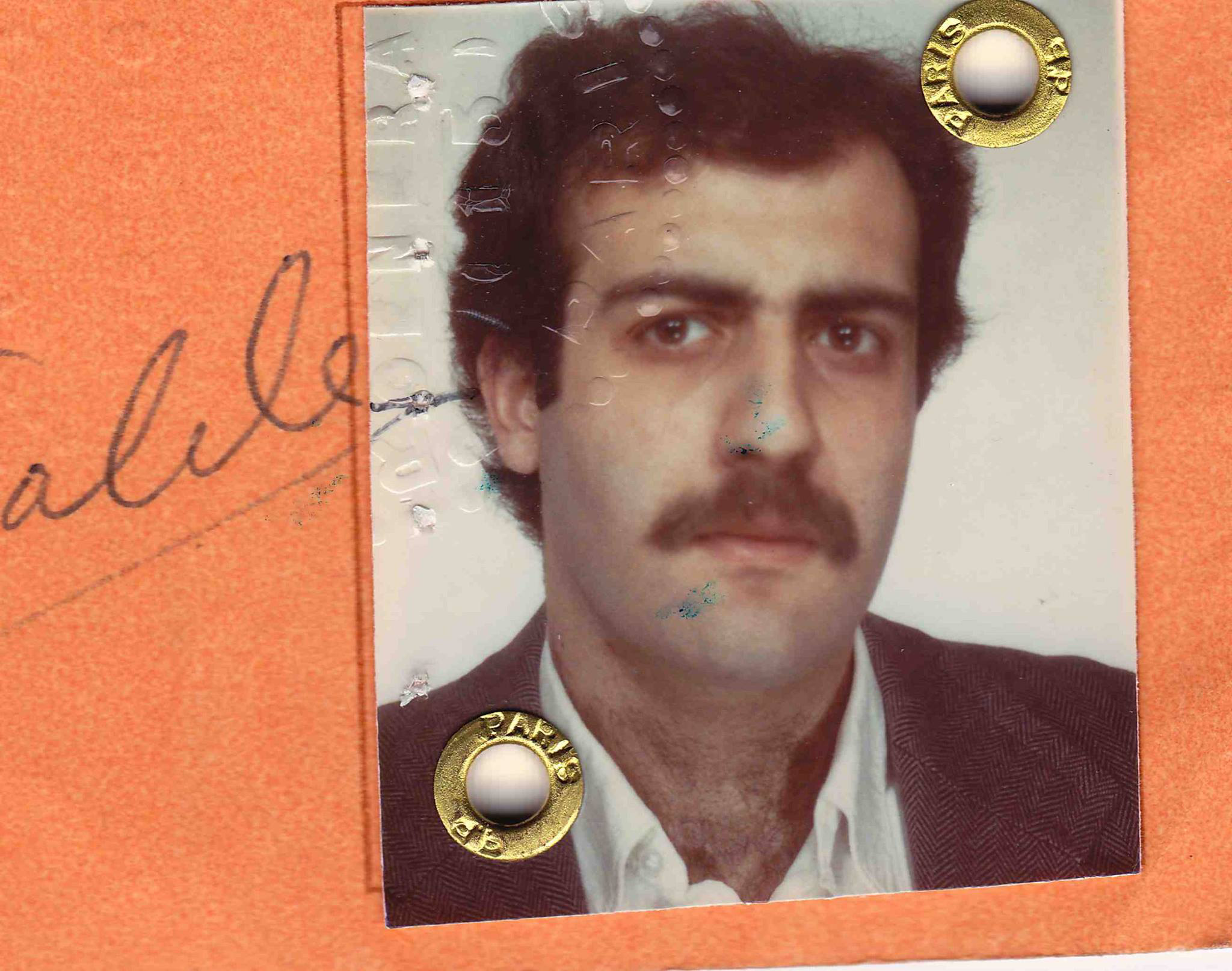

Nicholas Taleb

Nassim Nicholas Taleb (; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty. ''The Sunday Times'' called his 2007 book '' The Black Swan'' one of the 12 most influential books since World War II. Taleb is the author of the ''Incerto'', a five-volume philosophical essay on uncertainty published between 2001 and 2018 (of which the best-known books are ''The Black Swan'' and ''Antifragile''). He has been a professor at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has been co-editor-in-chief of the academic journal ''Risk and Decision Analysis'' since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, and a derivatives trader, and i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Universa Investments

Universa Investments ("Universa") is an American investment management firm headquartered in Miami, Florida. It is known as a Black Swan fund that focuses on risk mitigation to protect investors from sharp market downturns. Background Universa Investments was founded in January 2007 by Mark Spitznagel with Nassim Nicholas Taleb acting as its advisor. The two of them previously ran Empirica Capital, a hedge fund that closed in 2004 due to subpar returns. Universa was launched with $300 million under management and traded out of a small office in Santa Monica, California. Software programs were developed to search the options markets for deals. Universa and Empirica followed the Black swan theory which was about unexpected extreme events that have significant impact on the world and the financial markets. The strategy would be to buy out-of-the-money put options at low prices during periods the financial markets are good to protect the firm's position when there is a market do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Funds

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages include an ability to: * hire professional investment managers, who may offer better returns and more adequate risk management; * benefit from economies of scale, i.e., lower transaction costs; * increase the asset diversification to reduce some unsystematic risk. It remains unclear whether professional active investment managers can reliably enhance risk adjusted returns by an amount that exceeds fees and expenses of investment management. Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. The regulatory term is undertaking for collective investment in transferable securities, or short collective invest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |