|

Biflation

Biflation (sometimes mixflation) is a state of the economy, in which the processes of inflation and deflation occur simultaneously in different parts of the economy. The term was first coined in 2003 by F. Osborne Brown, a senior financial analyst at Phoenix Investment Group, and has later been widely used in the media. During the biflation, there is a simultaneous rise in prices (inflation) for commodities bought out of the basic income (earnings), and a parallel fall in prices (deflation) for goods bought mainly on credit. Biflation may be seen in the CPI composition: some CPI components are in the inflationary territory, while others are facing deflationary pressure. As such, biflation reflects the complexity of the modern financial system. Overview Biflation is a type of Cantillon effect occurring when monetary authorities apply the expansionary monetary policy in an attempt to alleviate a recession. Biflation is an unusual, yet temporary, situation taking place in a fragile eco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stagflation

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment. The term, a portmanteau of '' stagnation'' and ''inflation'', is generally attributed to Iain Macleod, a British Conservative Party politician who became Chancellor of the Exchequer in 1970. Macleod used the word in a 1965 speech to Parliament during a period of simultaneously high inflation and unemployment in the United Kingdom.Introduction, page 9. Warning the House of Commons of the gravity of the situation, he said: Macleod used the term again on 7 July 1970, and the media began also to use it, for example in ''The Economist'' on 15 August 1970, and ''Newsweek'' on 19 March 1973. John Maynard Keynes did not use the term, but some of his work refers to the conditions that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bloomsbury Publishing

Bloomsbury Publishing plc is a British worldwide publishing house of fiction and non-fiction. It is a constituent of the FTSE SmallCap Index. Bloomsbury's head office is located in Bloomsbury, an area of the London Borough of Camden. It has a US publishing office located in New York City, an India publishing office in New Delhi, an Australia sales office in Sydney CBD and other publishing offices in the UK including in Oxford. The company's growth over the past two decades is primarily attributable to the ''Harry Potter'' series by J. K. Rowling and, from 2008, to the development of its academic and professional publishing division. The Bloomsbury Academic & Professional division won the Bookseller Industry Award for Academic, Educational & Professional Publisher of the Year in both 2013 and 2014. Divisions Bloomsbury Publishing group has two separate publishing divisions—the Consumer division and the Non-Consumer division—supported by group functions, namely Sales and Mar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Globalisation

Economic globalization is one of the three main dimensions of globalization commonly found in academic literature, with the two others being political globalization and cultural globalization, as well as the general term of globalization. Economic globalization refers to the widespread international movement of goods, capital, services, technology and information. It is the increasing economic integration and interdependence of national, regional, and local economies across the world through an intensification of cross-border movement of goods, services, technologies and capital. Economic globalization primarily comprises the globalization of production, finance, markets, technology, organizational regimes, institutions, corporations, and people.James et al., vols. 1–4 (2007) While economic globalization has been expanding since the emergence of trans-national trade, it has grown at an increased rate due to improvements in the efficiency of long-distance transportation, advan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomic Aggregates

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as GDP (Gross Domestic Product), unemployment (including unemployment rates), national income, price indices, output, consumption, inflation, saving, investment, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The United Nations Sustainable Development Goal 17 has a target to enhanc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade".William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing, commonly known as "Investments", and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

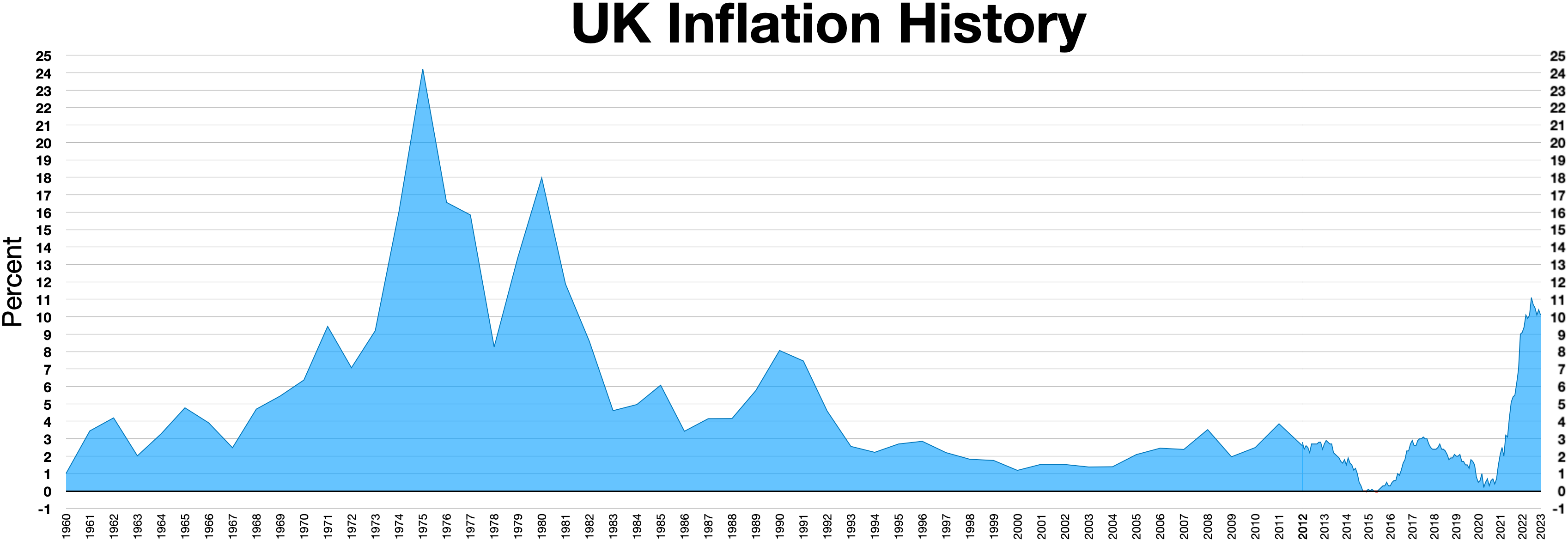

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zero Interest-rate Policy

Zero interest-rate policy (ZIRP) is a macroeconomic concept describing conditions with a very low nominal interest rate, such as those in contemporary Japan and in the United States from December 2008 through December 2015. ZIRP is considered to be an unconventional monetary policy instrument and can be associated with slow economic growth, deflation and deleverage. Overview Under ZIRP, the central bank maintains a 0% nominal interest rate. The ZIRP is an important milestone in monetary policy because the central bank is typically no longer able to reduce nominal interest rates. ZIRP is very closely related to the problem of a liquidity trap, where nominal interest rates cannot adjust downward at a time when savings exceed investment. However, some economists—such as market monetarists—believe that unconventional monetary policy such as quantitative easing can be effective at the zero lower bound. Others argue that when monetary policy is already used to the maximal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shrinkflation

In economics, shrinkflation, also known as the grocery shrink ray, deflation, or package downsizing, is the process of items shrinking in size or quantity, or even sometimes reformulating or reducing quality, while their prices remain the same or increase. The word is a portmanteau of the words ''shrink'' and ''inflation''. First usage of the term "shrinkflation" with its current meaning has been attributed to the economist Pippa Malmgren, though the same term had been used earlier to refer to an economy shrinking while also suffering high inflation. Shrinkflation allows companies to increase their operating margin and profitability by reducing costs whilst maintaining sales volume, and is often used as an alternative to raising prices in line with inflation. Consumer protection groups are critical of the practice. Economic definition Shrinkflation is a rise in the general price level of goods per unit of weight or volume, brought about by a reduction in the weight or size ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Inflation

Monetary inflation is a sustained increase in the money supply of a country (or currency area). Depending on many factors, especially public expectations, the fundamental state and development of the economy, and the transmission mechanism, it is likely to result in price inflation, which is usually just called "inflation", which is a rise in the general level of prices of goods and services. There is general agreement among economists that there is a causal relationship between monetary inflation and price inflation. But there is neither a common view about the exact theoretical mechanisms and relationships, nor about how to accurately measure it. This relationship is also constantly changing, within a larger complex economic system. So there is a great deal of debate on the issues involved, such as how to measure the monetary base and price inflation, how to measure the effect of public expectations, how to judge the effect of financial innovations on the transmission mechanis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt ( financial instrument) which yields so low a rate of interest." Keynes, John Maynard (1936) ''The General Theory of Employment, Interest and Money'', United Kingdom: Palgrave Macmillan, 2007 edition, A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Among the characteristics of a liquidity trap are interest rates that are close to zero and changes in the money supply that fail to translate into changes in the price level. Krugman, Paul R. (1998)"It's baack: Japan's Slump and the Return of the Liquidity Trap," Brookings Papers on Economic Activity Origin and definition of the term John Maynard Keynes, in his 1936 ''Gener ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflationism

Inflationism is a heterodox economic, fiscal, or monetary policy, that predicts that a substantial level of inflation is harmless, desirable or even advantageous. Similarly, inflationist economists advocate for an inflationist policy. Mainstream economics holds that inflation is a necessary evil, and advocates a low, stable level of inflation, and thus is largely opposed to inflationist policies – some inflation is necessary, but inflation beyond a low level is not desirable. However, deflation is often seen as a worse or equal danger, particularly within Keynesian economics, as well as Monetarist economics and in the theory of debt deflation. Inflationism is not accepted within the economics community, and is often conflated with Modern Monetary Theory, which uses similar arguments, especially in relation to chartalism. Political debate In political debate, inflationism is opposed to hard currency, which believes that the real value of currency should be maintained. In late ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Stagnation

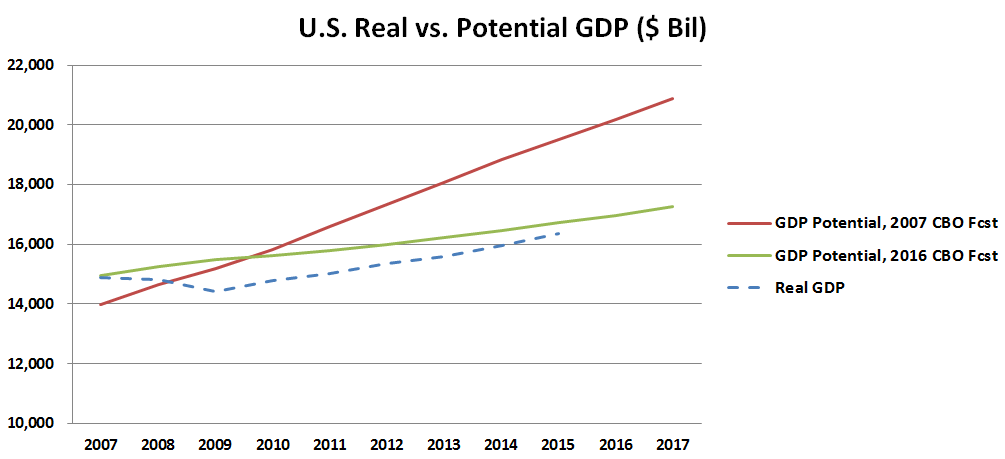

Economic stagnation is a prolonged period of slow economic growth (traditionally measured in terms of the GDP growth), usually accompanied by high unemployment. Under some definitions, "slow" means significantly slower than potential growth as estimated by macroeconomists, even though the growth rate may be nominally higher than in other countries not experiencing economic stagnation. Secular stagnation theory The term "secular stagnation" was originally coined by Alvin Hansen in 1938 to "describe what he feared was the fate of the American economy following the Great Depression of the early 1930s: a check to economic progress as investment opportunities were stunted by the closing of the frontier and the collapse of immigration". Warnings similar to secular stagnation theory have been issued after all deep recessions, but they usually turned out to be wrong because they underestimated the potential of existing technologies.Pagano and Sbracia (2014"The secular stagnation hypo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |