|

Bankleitzahl

In Germany and Austria, the (BLZ) is a code that uniquely identifies a bank. The bank code always consists of eight digits in Germany and five digits in Austria. In Switzerland and Liechtenstein, the bank clearing number (BC number) has the same meaning. The bank sort code must be specified for many business transactions in payment transactions (e.g. bank transfer). With the establishment of the Single Euro Payments Area (SEPA), which completely replaced the national payment systems from 1 February 2014, the bank codes in the participating countries were replaced by BIC (Business Identifier Code), also known as SWIFT code. At the same time, in some countries, including Germany, the bank routing numbers became part of the International Bank Account Number (IBAN) together with the account number. See also * ABA routing transit number for American equivalent * Routing number (Canada) for Canadian equivalent * Sort code Sort codes are the domestic bank codes used to route money t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Bank Account Number

The International Bank Account Number (IBAN) is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution. It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. As of May 2020, 77 countries were using the IBAN numbering system. The IBAN consists of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Code

A bank code is a code assigned by a central bank, a bank supervisory body or a Bankers Association in a country to all its licensed member banks or financial institutions. The rules vary to a great extent between the countries. Also the name of bank codes varies. In some countries the bank codes can be viewed over the internet, but mostly in the local language. The (national) bank codes differ from the international Bank Identifier Code (BIC/ISO 9362, a normalized code - also known as Business Identifier Code, Bank International Code and SWIFT code). Those countries which use International Bank Account Numbers (IBAN) have mostly integrated the bank code into the prefix of specifying IBAN account numbers. The bank codes also differ from the Bank card code (CSC). The term "bank code" is sometimes (inappropriately) used by merchants to refer to the Card Security Code printed on the back of a credit card. Europe * Belgium has a national system with account numbers of 12 digits. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Routing Number (Canada)

A routing number is the term for bank codes in Canada. Routing numbers consist of eight numerical digits with a dash between the fifth and sixth digit for paper financial documents encoded with magnetic ink character recognition and nine numerical digits without dashes for electronic funds transfers. Routing numbers are regulated by Payments Canada, formerly known as the Canadian Payments Association, to allow easy identification of the branch location and financial institution associated with an account. Format A routing number consists of a five digit ''transit number'' (also called ''branch number'') identifying the branch where an account is held and a three digit ''financial institution number'' corresponding to the financial institution. The number is given as one of the following forms, where XXXXX is the transit number and YYY is the financial institution number: * for MICR-encoded documents * for electronic funds transfers A leading zero is used when formatting a rout ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sort Code

Sort codes are the domestic bank codes used to route money transfers between financial institutions in the United Kingdom, and in the Republic of Ireland. They are six-digit hierarchical numerical addresses that specify clearing banks, clearing systems, regions, large financial institutions, groups of financial institutions and ultimately resolve to individual branches. In the UK they continue to be used to route transactions domestically within clearance organisations and to identify accounts, while in the Republic of Ireland (a founder member of the Euro) they have been deprecated and replaced by the SEPA systems and infrastructure. Sort codes for Northern Ireland branches of banks (codes beginning with a '9') were registered with the Irish Payment Services Organisation (IPSO) for both Northern Ireland and the Republic. These codes are used in the British clearing system and historically in the Irish system. The sort code is usually formatted as three pairs of numbers, for exa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Clearing Number

A bank clearing number or BC number is a number used for the identification of financial institutions in Switzerland and Liechtenstein. Bank clearing numbers are connected to the Swiss Interbank Clearing The Swiss Interbank Clearing (SIC) system is a mechanism for the clearing of domestic and international payments. History The development of the SIC started in 1980. Since 1987, the SIC system has been operated by SIX Interbank Clearing (100% o ... and the EuroSIC system. Bank clearing numbers consists of 3 to 5 digits. To identify a particular branch of a financial institution clearly, a store ID is specified in addition to the bank clearing number. List of bank clearing numbers The first digit of the bank clearing number represents the institution: External links Download BC-Bankenstamm bei SIX Interbank Clearing (ge) {{Bank codes and identification Banking in Switzerland Banking technology Bank codes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Giro (banking)

A giro transfer, often shortened to giro (), is a payment transfer from one bank account to another bank account and initiated by the payer, not the payee. The debit card has a similar model. Giros are primarily used in Europe; although electronic payment systems exist in the United States (e.g., the Automated Clearing House) and Canada (e.g., Interac e-transfer), it is not possible to perform third-party transfers with them. In the European Union, there is the Single Euro Payments Area (SEPA), which allows electronic giro or debit card payments in euros to be executed to any euro bank account in the area. Name The word "giro" is borrowed from Dutch "''giro''" and/or German "''giro''", which are both from the Italian "''giro''" meaning "circulation of money". The Italian term comes via the Latin "''gyrus''" meaning "gyre" from the Greek "''gyros''" meaning "circle". History and concept Giro systems date back at least to Ptolemaic Egypt in the 4th century BC. State granary d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Single Euro Payments Area

The Single Euro Payments Area (SEPA) is a payment-integration initiative of the European Union for simplification of bank transfers denominated in euro. , there were 36 members in SEPA, consisting of the 27 member states of the European Union, the four member states of the European Free Trade Association (Iceland, Liechtenstein, Norway and Switzerland), and the United Kingdom. Some microstates participate in the technical schemes: Andorra, Monaco, San Marino, and Vatican City. SEPA covers predominantly normal bank transfers. Payment methods which have additional optional features or services, such as mobile phone or smart card payment systems, are not directly covered. However, the instant SEPA payment scheme facilitates payment products also on smart devices. Goals The aim of SEPA is to improve the efficiency of cross-border payments and turn the previously fragmented national markets for euro payments into a single domestic one. SEPA enables customers to make cashless eu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SWIFT

Swift or SWIFT most commonly refers to: * SWIFT, an international organization facilitating transactions between banks ** SWIFT code * Swift (programming language) * Swift (bird), a family of birds It may also refer to: Organizations * SWIFT, an international organization facilitating transactions between banks * Swift Engineering, an American engineering firm * Swift & Company, a meat processing company * Swifts (aerobatic team), a Russian aerobatic team Transportation companies * Swift Cooper, a British racing car manufacturer * Swift Leisure, a British manufacturer of caravans * Swift Motor Company, of Coventry, England * Swift Transportation, a US trucking company Places * River Swift, a river in England * Swift, Illinois, an unincorporated community in northeastern Illinois * Swift County, Minnesota, a county in west-central Minnesota * Swift, Minnesota, an unincorporated community in northern Minnesota * Swift, Missouri, a ghost town in southeastern Missouri As ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

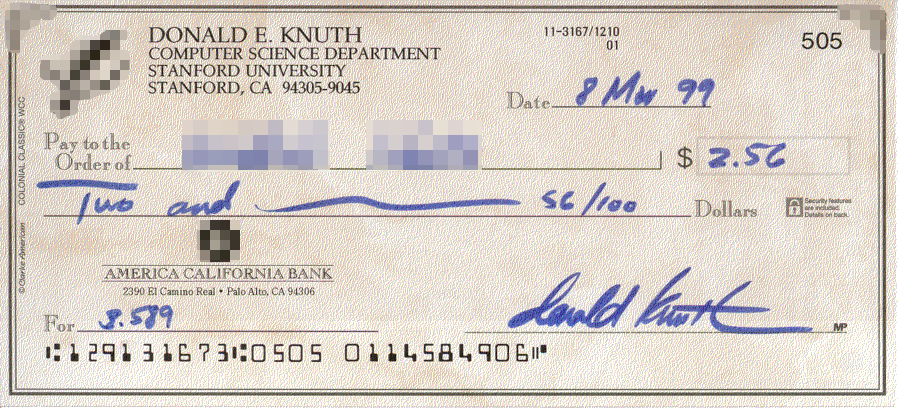

ABA Routing Transit Number

In the United States, an ABA routing transit number (ABA RTN) is a nine-digit code printed on the bottom of checks to identify the financial institution on which it was drawn. The American Bankers Association (ABA) developed the system in 1910 to facilitate the sorting, bundling, and delivering of paper checks to the drawer's (check writer's) bank for debit to the drawer's account. Newer electronic payment methods continue to rely on ABA RTNs to identify the paying bank or other financial institution. The Federal Reserve Bank uses ABA RTNs in processing Fedwire funds transfers. The ACH Network also uses ABA RTNs in processing direct deposits, bill payments, and other automated money transfers. Management Since 1911, the American Bankers Association has partnered with a series of registrars, currently Accuity, to manage the ABA routing number system. Accuity is the Official Routing Number Registrar and is responsible for assigning ABA RTNs and managing the ABA RTN system. Ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Codes

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a Bank regulation, high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concept ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In Germany

Banking in Germany is a highly leveraged industry, as its average leverage ratio (assets divided by net worth) as of 11 October 2008 is 52 to 1 (while, in comparison, that of France is 28 to 1 and United Kingdom is 24 to 1); its short-term liabilities are equal to 60% of the German GDP or 167% of its national debt. History From the 15th century, banking families such as Fugger, Welser and Hochstetter were international mercantile bankers and venture capitalists. The oldest bank still in existence in Germany, Berenberg Bank, was founded by Dutch brothers Hans and Paul Berenberg in 1590, is still owned by the Berenberg family, and is the world's oldest or second oldest bank, depending on the exact definition. Market overview Germany has universal banking. The private customer mostly has to choose between three kinds of banks (German "three pillar system"): (A) private banks (including direct banks): *the largest ones are Deutsche Bank, Postbank (acquired by Deutsche Bank), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |