|

Bank Of Mongolia

The Bank of Mongolia, or Mongolbank (), is the central bank of Mongolia. The main objective of the Bank of Mongolia is to ensure stability of the Mongolian tögrög. Within its main objective the Bank of Mongolia promotes balanced and sustained development of the national economy, through maintaining the stability of money, financial markets and the banking system. History A joint Mongolian-Russian bank, called the "Trade and Industry Bank of Mongolia" (Bank of Mongolia) was opened on June 2, 1924 in Altanbulag with a single branch. At that time, the bank's capital was 260000 yanchaan (the currency of the period). It operated with 22 employees, 18 of which were Russian specialists and 4 of them were Mongolian. At the start, the joint bank was called by two names, "Trade and Industry Bank of Mongolia", and the "Bank of Mongolia", but it was named the Bank of Mongolia in official papers and documents. Due to the absence of a national currency, the bank faced difficulties in f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

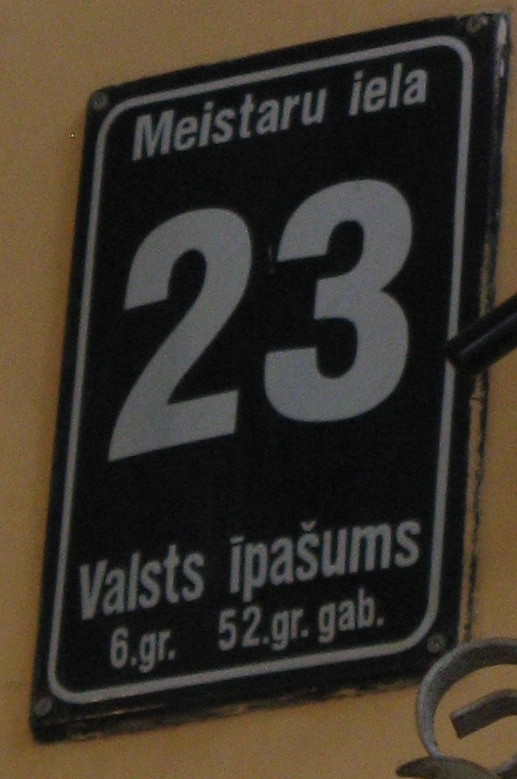

State Owned

State ownership, also called government ownership and public ownership, is the ownership of an industry, asset, or enterprise by the state or a public body representing a community, as opposed to an individual or private party. Public ownership specifically refers to industries selling goods and services to consumers and differs from public goods and government services financed out of a government's general budget. Public ownership can take place at the national, regional, local, or municipal levels of government; or can refer to non-governmental public ownership vested in autonomous public enterprises. Public ownership is one of the three major forms of property ownership, differentiated from private, collective/cooperative, and common ownership. In market-based economies, state-owned assets are often managed and operated as joint-stock corporations with a government owning all or a controlling stake of the company's shares. This form is often referred to as a state-o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit (accounting)

Profit, in accounting, is an income distributed to the ownership , owner in a Profit (economics) , profitable market production process (business). Profit is a measure of profitability which is the owner's major interest in the income-formation process of market production. There are several profit measures in common use. Income formation in market production is always a balance between income generation and income distribution. The income generated is always distributed to the Stakeholder (corporate), stakeholders of production as economic value within the review period. The profit is the share of income formation the owner is able to keep to themselves in the income distribution process. Profit is one of the major sources of economics , economic well-being because it means incomes and opportunities to develop production. The words "income", "profit" and "earnings" are synonyms in this context. Measurement of profit There are several important profit measures in common use. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings And Credit Cooperative

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision of credit, and other financial services. In several African countries, credit unions are commonly referred to as SACCOs (Savings and Credit Co-Operative Societies). Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 274 million, with nearly 40 million members having been added since 2016. Leading up to the financial crisis of 2007–2008, commercial banks engaged in approximately five times more subprime lending relative to credit unions and were two and a half ti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-bank Financial Institution

A non-banking financial institution (NBFI) or non-bank financial company (NBFC) is a financial institution that does not have a full banking license or is not supervised by a national or international banking regulatory agency. NBFC facilitate bank-related financial services, such as investment, risk pooling, contractual savings, and market brokering. Examples of these include insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations. Alan Greenspan has identified the role of NBFIs in strengthening an economy, as they provide "multiple alternatives to transform an economy's savings into capital investment which act as backup facilities should the primary form of intermediation fail." The term ''non-bank'' likely started as non-deposit taking banking institution. However, due to financial regulations adopted from English speaking countries, non-English speaking countries took "non-bank" as a s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crisis Of 2007-2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assessmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Requirement

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital adequacy ratio of equity as a percentage of risk-weighted assets. These requirements are put into place to ensure that these institutions do not take on excess leverage and risk becoming insolvent. Capital requirements govern the ratio of equity to debt, recorded on the liabilities and equity side of a firm's balance sheet. They should not be confused with reserve requirements, which govern the assets side of a bank's balance sheet—in particular, the proportion of its assets it must hold in cash or highly-liquid assets. Capital is a source of funds not a use of funds. Regulations A key part of bank regulation is to make sure that firms operating in the industry are prudently managed. The aim is to protect the firms themselves, their custo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nadmidyn Bayartsaikhan

Nadmidyn Bayartsaikhan (born January 27, 1962) is a Mongolian social scientist, politician, and government minister. After teaching social science, he obtained a doctorate in economics and was elected to the State Great Khural four times. He also served as the Mongolian Minister of Finance from 2006 to 2007. After leaving politics, Bayartsaikhan became the President of the Bank of Mongolia, holding that position from 2016 to 2019. Early life and education Bayartsaikhan was born on 27 January, 1962, in Ulaanbaatar. He attended the Irkutsk University of Economics, graduating in 1982. He then taught social sciences at the Higher Party School until 1989. From 1989 to 1992, he studied economics at the State University of Management in Moscow, Russia. There he obtained a doctorate degree in economics. Career In 1992, Bayartsaikhan was elected to represent the Khan Uul District of the Uvs-Aimak Province in the State Great Khural. In November 1993 he was elected to the Mongolian Peopl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alag Batsukh

''Alag'' ( en, Different) is a 2006 Indian Hindi science fiction film starring Akshay Kapoor and Dia Mirza and directed by Ashu Trikha and produced by Subi Samuel. The protagonist is a man with extraordinary supernatural powers and with no hair on his entire body. Although, the film failed at the box office, Akshay Kapoor got good reviews for his performances in the film. The film is an unofficial copy of the Hollywood movie Powder'' ( Directed by Victor Salva). Plot Widower Hemant Rastogi lives in scenic Mahabaleshwar, seemingly alone. One night he has a heart attack and passes away. When the police search his residence, they find Tejas, Hemant's only son, in the basement of the house. Tejas has spent his entire life in the basement, since he was extremely sensitive to sunlight, according to the doctor's, when Tejas' father took him there because his eyes turned red. The Police ask Purva Rana, head of P.R. Institute (an institute for the rehabilitation of young criminals), to l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |