|

Budget Protest League

The Budget Protest League was a British pressure group formed in June 1909 and led by Walter Long to oppose David Lloyd George's "People's Budget" outside of Parliament. The League attacked the Budget's Finance (1909-10) Act 1910 as Socialist because of its income tax rises, increased death duties, and a land value tax in order to redistribute this to old age pensions. It was not linked to tariff reform. It produced posters outlining its opposition to Lloyd George and the Budget. In a letter to ''The Times'' announcing the formation of the Budget Protest League, Long said: It is unconstitutional to endeavour to secure, under cover of a Finance Bill, the acceptance by Parliament of legislative proposals very similar to, if not identical with, those which were rejected by the House of Lords last year...it is generally recognized by Socialists themselves that it embodies principles which are frankly Socialistic. Moreover, the increased expenditure upon naval construction is whol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Socialism Throttling The Country

Socialism is a left-wing Economic ideology, economic philosophy and Political movement, movement encompassing a range of economic systems characterized by the dominance of social ownership of the means of production as opposed to Private property, private ownership. As a term, it describes the Economic ideology, economic, Political philosophy, political and Social theory, social theories and Political movement, movements associated with the implementation of such systems. Social ownership can be State ownership, state/public, Community ownership, community, Collective ownership, collective, cooperative, or Employee stock ownership#Employee ownership, employee. While no single definition encapsulates the many types of socialism, social ownership is the one common element. Different types of socialism vary based on the role of markets and planning in resource allocation, on the structure of management in organizations, and from below or from above approaches, with some socialists ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Land Value Tax

A land value tax (LVT) is a levy on the value of land (economics), land without regard to buildings, personal property and other land improvement, improvements. It is also known as a location value tax, a point valuation tax, a site valuation tax, split rate tax, or a site-value rating. Land value taxes are generally favored by economists as they do not cause economic efficiency, economic inefficiency, and reduce economic inequality, inequality. A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income. The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century. Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity or discourage or subsidize development. LVT is associated with Henry George, whose ideology became known as Georgism. George ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1909 Establishments In The United Kingdom

Nineteen or 19 may refer to: * 19 (number), the natural number following 18 and preceding 20 * one of the years 19 BC, AD 19, 1919, 2019 Films * ''19'' (film), a 2001 Japanese film * ''Nineteen'' (film), a 1987 science fiction film Music * 19 (band), a Japanese pop music duo Albums * ''19'' (Adele album), 2008 * ''19'', a 2003 album by Alsou * ''19'', a 2006 album by Evan Yo * ''19'', a 2018 album by MHD * ''19'', one half of the double album ''63/19'' by Kool A.D. * ''Number Nineteen'', a 1971 album by American jazz pianist Mal Waldron * ''XIX'' (EP), a 2019 EP by 1the9 Songs * "19" (song), a 1985 song by British musician Paul Hardcastle. * "Nineteen", a song by Bad4Good from the 1992 album ''Refugee'' * "Nineteen", a song by Karma to Burn from the 2001 album ''Almost Heathen''. * "Nineteen" (song), a 2007 song by American singer Billy Ray Cyrus. * "Nineteen", a song by Tegan and Sara from the 2007 album '' The Con''. * "XIX" (song), a 2014 song by Slipknot. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Organizations Established In 1909

An organization or organisation (Commonwealth English; see spelling differences), is an entity—such as a company, an institution, or an association—comprising one or more people and having a particular purpose. The word is derived from the Greek word ''organon'', which means tool or instrument, musical instrument, and organ. Types There are a variety of legal types of organizations, including corporations, governments, non-governmental organizations, political organizations, international organizations, armed forces, charities, not-for-profit corporations, partnerships, cooperatives, and educational institutions, etc. A hybrid organization is a body that operates in both the public sector and the private sector simultaneously, fulfilling public duties and developing commercial market activities. A voluntary association is an organization consisting of volunteers. Such organizations may be able to operate without legal formalities, depending on jurisdiction, includi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Political History Of The United Kingdom

The United Kingdom is a unitary state with devolution that is governed within the framework of a parliamentary democracy under a constitutional monarchy in which the monarch, currently Charles III, King of the United Kingdom, is the head of state while the Prime Minister of the United Kingdom, Rishi Sunak, is the head of government. Executive power is exercised by the British government, on behalf of and by the consent of the monarch, and the devolved governments of Scotland, Wales and Northern Ireland. Legislative power is vested in the two chambers of the Parliament of the United Kingdom, the House of Commons and the House of Lords, as well as in the Scottish, Northern Irish and Welsh parliaments. The British political system is a two party system. Since the 1920s, the two dominant parties have been the Conservative Party and the Labour Party. Before the Labour Party rose in British politics, the Liberal Party was the other major political party, along with the Conserv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Winston Churchill

Sir Winston Leonard Spencer Churchill (30 November 187424 January 1965) was a British statesman, soldier, and writer who served as Prime Minister of the United Kingdom twice, from 1940 to 1945 Winston Churchill in the Second World War, during the Second World War, and again from 1951 to 1955. Apart from two years between 1922 and 1924, he was a Member of Parliament (United Kingdom), Member of Parliament (MP) from 1900 to 1964 and represented a total of five UK Parliament constituency, constituencies. Ideologically an Economic liberalism, economic liberal and British Empire, imperialist, he was for most of his career a member of the Conservative Party (UK), Conservative Party, which he led from 1940 to 1955. He was a member of the Liberal Party (UK), Liberal Party from 1904 to 1924. Of mixed English and American parentage, Churchill was born in Oxfordshire to Spencer family, a wealthy, aristocratic family. He joined the British Army in 1895 and saw action in British Raj, Br ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

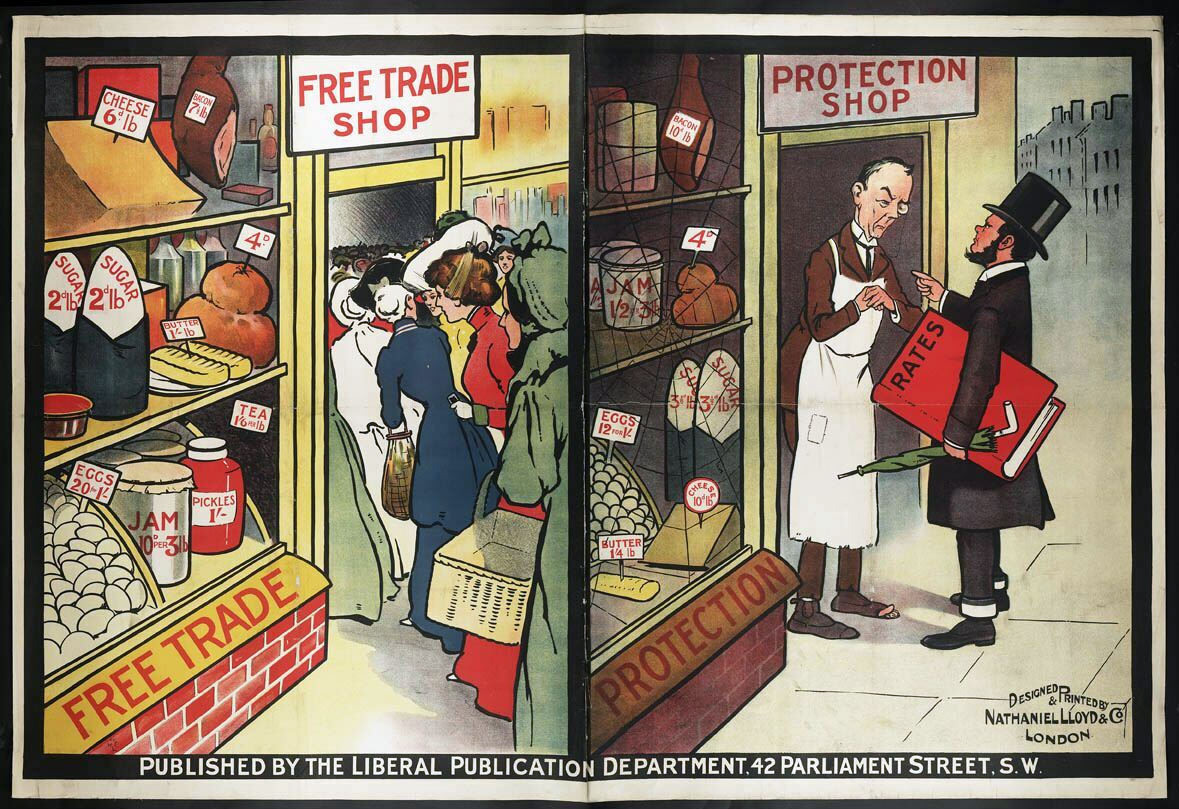

Budget League

The Budget League was a British pressure group formed in 1909 by Winston Churchill to publicly campaign in favour of David Lloyd George's People's Budget in reaction to the activities of the Budget Protest League. The foundation of the League had not been discussed in the Cabinet and when Sir Henry Norman requested Cabinet ministers to speak at its meetings, nearly all of them refused to participate. However, after Jack Pease issued a circular to all Cabinet members, the League was able to announce that many leading Liberals would speak at its meetings. A conference on 9 July between the League's executive committee and the editors of twenty four Liberal-supporting newspapers arranged the publication and press campaign of the League. Charles Masterman chaired a Literature Sub-committee to produce pamphlets, leaflets, cartoons and posters. At a meeting of the League's executive on 21 July, they decided upon three classes of meetings; Class A would be addressed by Cabinet members ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. Proponents argue that protectionist policies shield the producers, businesses, and workers of the Import substitution industrialization, import-competing sector in the country from foreign competitors. Opponents argue that protectionist policies reduce trade and adversely affect consumers in general (by raising the cost of imported goods) as well as the producers and workers in export sectors, both in the country implementing protectionist policies and in the countries protected against. Protectionism is advocated mainly by parties that hold Economic nationalism, economic nationalist or left-wing positions, while economically right-wing political parties generally support free trade. There is a consensus among economists that protectioni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions. Called ''retirement plans' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. International tax law distinguishes between an estate tax and an inheritance tax—an estate tax is assessed on the assets of the deceased, while an inheritance tax is assessed on the legacies received by the estate's beneficiaries. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. For historical reasons, the term death duty is still used colloquially (though not legally) in the UK and some Commonwealth countries. For political, statutory and other reasons, the term death tax is sometimes used to refer to estate tax in the United States. Varieties of inheritance and estate taxes * Belgium, droits de succession or erfbelasting (Inheritance tax). Collected at t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pressure Group

Advocacy groups, also known as interest groups, special interest groups, lobbying groups or pressure groups use various forms of advocacy in order to influence public opinion and ultimately policy. They play an important role in the development of political and social systems. Motives for action may be based on political, religious, moral, or commercial positions. Groups use varied methods to try to achieve their aims, including lobbying, media campaigns, awareness raising publicity stunts, polls, research, and policy briefings. Some groups are supported or backed by powerful business or political interests and exert considerable influence on the political process, while others have few or no such resources. Some have developed into important social, political institutions or social movements. Some powerful advocacy groups have been accused of manipulating the democratic system for narrow commercial gain and in some instances have been found guilty of corruption, fraud, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)