|

Bank Emisyjny W Polsce

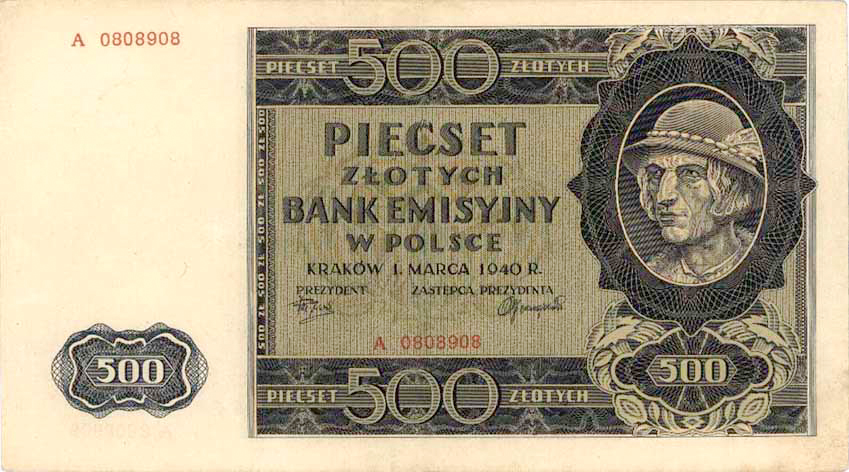

Bank of Issue in Poland ( pl, Bank Emisyjny w Polsce, german: Emissionbank in Polen, also translated into English variously as the ''Bank of Issue'', ''Issue Bank'', ''Issuing Bank'' or ''Emitting Bank in Poland'') was a bank created by Nazi Germany in the General Government ( occupied Poland) in 1940.Jerzy Jan Lerski, Piotr Wróbel, Richard J. Kozicki, ''Historical Dictionary of Poland, 966-1945'', Greenwood Publishing Group, 1996, Google Print, p. 26/ref> Creation After the German invasion of Poland, the Reichsbank decided not to introduce German currency there, as it did not want to increase the money supply. Instead, it introduced a system of Reichskreditkassen (''credit offices of the German Reich''), which issued temporary bonds. This system, intended to be temporary from the beginning, was to be replaced by a new German-controlled currency and central banks in occupied territories.Andrzej Gójski, ''Etapy i cele niemieckiej polityki bankowej w GG. Plany niemieckie wobe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

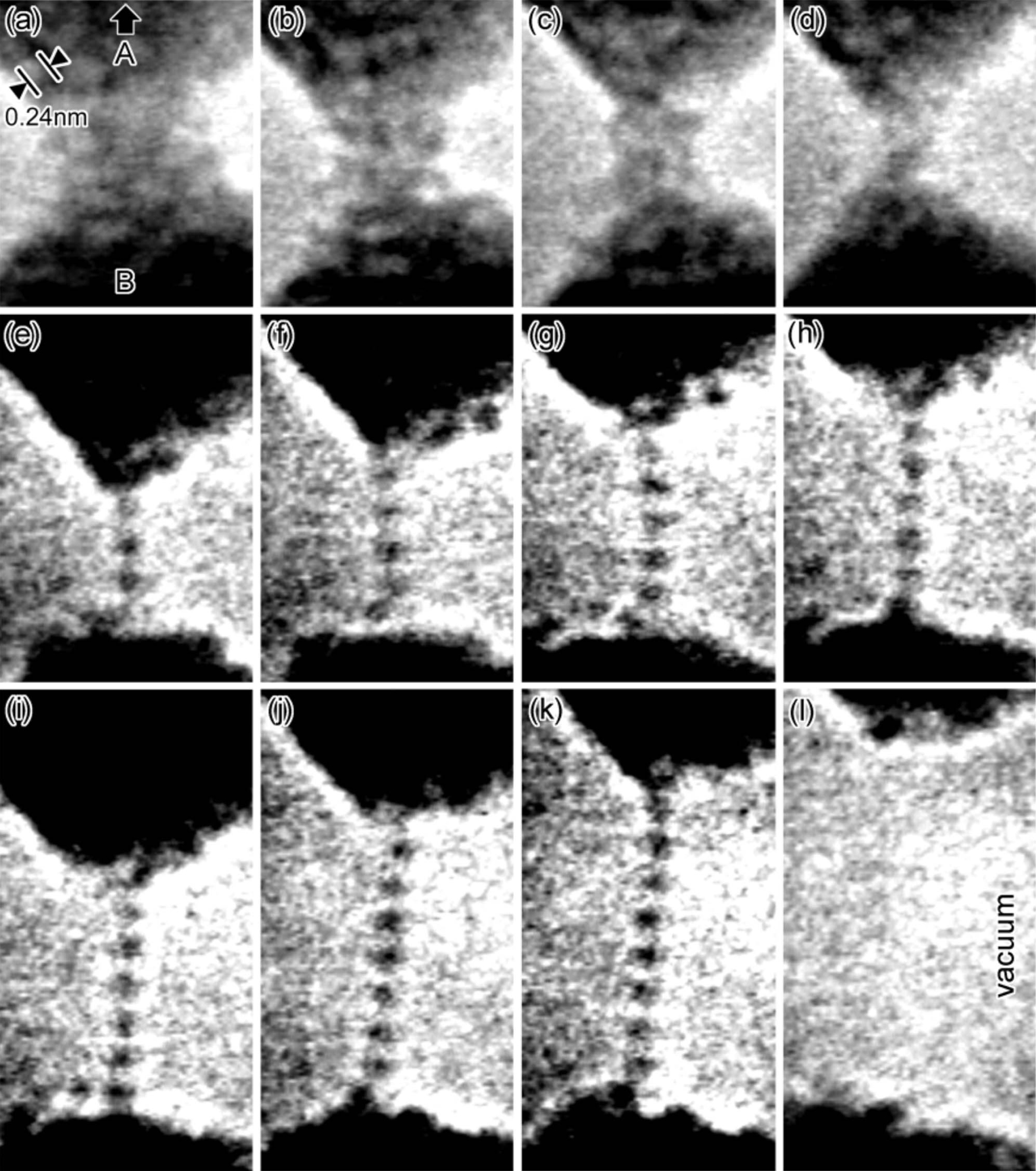

Gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile metal in a pure form. Chemically, gold is a transition metal and a group 11 element. It is one of the least reactive chemical elements and is solid under standard conditions. Gold often occurs in free elemental ( native state), as nuggets or grains, in rocks, veins, and alluvial deposits. It occurs in a solid solution series with the native element silver (as electrum), naturally alloyed with other metals like copper and palladium, and mineral inclusions such as within pyrite. Less commonly, it occurs in minerals as gold compounds, often with tellurium (gold tellurides). Gold is resistant to most acids, though it does dissolve in aqua regia (a mixture of nitric acid and hydrochloric acid), forming a soluble tetrachloroaurate anion. Gold is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Młynarki

Młynarki was the popular name for the currency notes of the General Government ( part of German-occupied Poland) during World War II that were issued by the German-controlled Bank of Issue in Poland. They were named after the president of the bank, Feliks Młynarski. History After the German invasion of Poland and the ensuing occupation, the Reichsbank decided not to introduce German currency there, as it did not want to increase the money supply. Various Polish banks and credit institutions were temporarily closed, while some of their assets were nationalized by the German government. Many people lost their savings. On 15 December 1939, Hans Frank, the governor of the General Government, an administrative unit for most of occupied Poland, passed a decree creating a new bank, the Bank of Issue in Poland (Bank Emisyjny), which began operating in April 1940. The bank was headed by Feliks Młynarski with the approval of the Polish government-in-exile. The official exchange ra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$)) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance - i.e. legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term "curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

German Army (Wehrmacht)

The German Army (, "army") is the land component of the armed forces of Federal Republic of Germany, Germany. The present-day German Army was founded in 1955 as part of the newly formed West German ''Bundeswehr'' together with the German Navy, ''Marine'' (German Navy) and the German Air Force, ''Luftwaffe'' (German Air Force). , the German Army had a strength of 62,766 soldiers. History Overview A German army equipped, organized, and trained following a single doctrine and permanently unified under one command in 1871 during the unification of Germany under the leadership of Prussia. From 1871 to 1919, the title ''German Army (German Empire), Deutsches Heer'' (German Army) was the official name of the German land forces. Following the German defeat in World War I and the end of the German Empire, the main army was dissolved. From 1921 to 1935 the name of the German land forces was the ''Reichswehr, Reichsheer'' (Army of the Empire) and from 1935 to 1945 the name ''German Army (We ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Capital

Financial capital (also simply known as capital or equity in finance, accounting and economics) is any economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or to provide their services to the sector of the economy upon which their operation is based, ''e.g.'', retail, corporate, investment banking, etc. In other words, financial capital is internal retained earnings generated by the entity or funds provided by lenders (and investors) to businesses in order to purchase real capital equipment or services for producing new goods and/or services. In contrast, real capital (or economic capital) comprises physical goods that assist in the production of other goods and services, e.g. shovels for gravediggers, sewing machines for tailors, or machinery and tooling for factories. IFRS concepts of capital maintenance ''Financial capital'' generally refers to saved-up financial wealth, especially that used in or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Market

A black market, underground economy, or shadow economy is a clandestine market or series of transactions that has some aspect of illegality or is characterized by noncompliance with an institutional set of rules. If the rule defines the set of goods and services whose production and distribution is prohibited by law, non-compliance with the rule constitutes a black market trade since the transaction itself is illegal. Parties engaging in the production or distribution of prohibited goods and services are members of the . Examples include the illegal drug trade, prostitution (where prohibited), illegal currency transactions, and human trafficking. Violations of the tax code involving income tax evasion in the . Because tax evasion or participation in a black market activity is illegal, participants attempt to hide their behavior from the government or regulatory authority. Cash is the preferred medium of exchange in illegal transactions since cash transactions are less-easi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reichsmark

The (; sign: ℛℳ; abbreviation: RM) was the currency of Germany from 1924 until 20 June 1948 in West Germany, where it was replaced with the , and until 23 June 1948 in East Germany, where it was replaced by the East German mark. The Reichsmark was subdivided into 100 s (Rpf or ℛ₰). The Mark is an ancient Germanic weight measure, traditionally a half pound, later used for several coins; whereas (''realm'' in English), comes from the official name for the German state from 1871 to 1945, . History The Reichsmark was introduced in 1924 as a permanent replacement for the Papiermark. This was necessary due to the 1920s German inflation which had reached its peak in 1923. The exchange rate between the old Papiermark and the Reichsmark was = 1012 ℳ (one trillion in American English and French, one billion in German and other European languages and British English of the time; see long and short scale). To stabilize the economy and to smooth the transition, the Papierm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque

A cheque, or check (American English; see spelling differences) is a document that orders a bank (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Promissory Note

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the ''maker'' or ''issuer'') promises in writing to pay a determinate sum of money to the other (the ''payee''), either at a fixed or determinable future time or on demand of the payee, under specific terms and conditions. Overview The terms of a note usually include the principal amount, the interest rate if any, the parties, the date, the terms of repayment (which could include interest) and the maturity date. Sometimes, provisions are included concerning the payee's rights in the event of a default, which may include foreclosure of the maker's assets. In foreclosures and contract breaches, promissory notes under CPLR 5001 allow creditors to recover prejudgement interest from the date interest is due until liability is established. For loans between individuals, writing and signing a promissory note are often ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)