|

Aware Super

Aware Super is an Australian superannuation fund headquartered in Sydney, New South Wales. With $150bn under management and over 1 million members, it is Australia's third-largest superannuation fund. History It was initially established in 1992 as First State Super to provide superannuation benefits to New South Wales government employees. First State Super became a public offer fund on 1 May 2006, opening up membership to anyone eligible to receive superannuation benefits. This was in response to feedback from existing members who were keen to remain with the fund when they changed jobs and moved from the public to the private sector. The change meant First State Super became included in comparisons of performance, fees and other features with other funds. In 2012, First State Super merged with Health Super, a not‐for‐profit superannuation fund for workers in the health and community services sector. At the time the merger meant the combined entity was the third largest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sydney

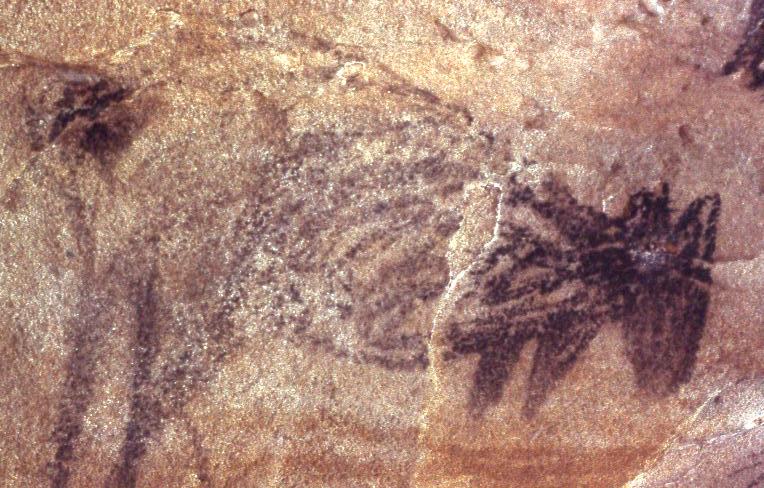

Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mountains to the west, Hawkesbury to the north, the Royal National Park to the south and Macarthur to the south-west. Sydney is made up of 658 suburbs, spread across 33 local government areas. Residents of the city are known as "Sydneysiders". The 2021 census recorded the population of Greater Sydney as 5,231,150, meaning the city is home to approximately 66% of the state's population. Estimated resident population, 30 June 2017. Nicknames of the city include the 'Emerald City' and the 'Harbour City'. Aboriginal Australians have inhabited the Greater Sydney region for at least 30,000 years, and Aboriginal engravings and cultural sites are common throughout Greater Sydney. The traditional custodians of the land on which modern Sydney stands are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New South Wales

) , nickname = , image_map = New South Wales in Australia.svg , map_caption = Location of New South Wales in AustraliaCoordinates: , subdivision_type = Country , subdivision_name = Australia , established_title = Before federation , established_date = Colony of New South Wales , established_title2 = Establishment , established_date2 = 26 January 1788 , established_title3 = Responsible government , established_date3 = 6 June 1856 , established_title4 = Federation , established_date4 = 1 January 1901 , named_for = Wales , demonym = , capital = Sydney , largest_city = capital , coordinates = , admin_center = 128 local government areas , admin_center_type = Administration , leader_title1 = Monarch , leader_name1 = Charles III , leader_title2 = Governor , leader_name2 = Margaret Beazley , leader_title3 = Premier , leader_name3 = Dominic Perrottet (Liberal) , national_representation = Parliament of Australia , national_representation_type1 = Senat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Superannuation

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions. Called ''retirement plans'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Industry Superannuation Fund

An industry superannuation fund (or, simply, 'industry fund') is an Australian superannuation fund originally established to provide for the retirement of workers from a specific industry. While industry funds are no longer tied to specific industries, they remain not-for-profit, mutual funds which are membership-based and do not have shareholders. Industry super funds can be contrasted with ''retail'' super funds (or 'wholesale master trusts'), which are public offer funds managed by financial institutions. Profits from retail funds are distributed to shareholders or investors (the trustees of the fund), whereas industry funds return profits directly to members. Industry Super Australia (ISA) is the peak body of the industry fund sector. From 1 July 2005, choice of fund rules came into effect, giving most Australian employees the option to choose the fund into which their employers paid their superannuation contributions. In practice, over 75% of workers remained with their e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Securities And Investments Commission

The Australian Securities and Investments Commission (ASIC) is an independent commission of the Australian Government tasked as the national corporate regulator. ASIC's role is to regulate company and financial services and enforce laws to protect Australian consumers, investors and creditors. ASIC was established on 1 July 1998 following recommendations from the Wallis Inquiry. ASIC's authority and scope are determined by the ''Australian Securities and Investments Commission Act 2001''. ASIC, which reports to the Treasurer, is responsible for the administering the following legislation: * ''Australian Securities and Investments Commission Act 2001'' (ASIC Act) * '' Business Names Registration Act 2011'' * ''Corporations Act 2001'' (Corporations Act) * ''Insurance Contracts Act 1984'' * ''National Consumer Credit Protection Act 2009'' (National Credit Act) Additionally, ASIC is also responsible for administering parts of the following legislation: * ''Banking Act 1959'' * ''Li ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Footprint

A carbon footprint is the total greenhouse gas (GHG) emissions caused by an individual, event, organization, service, place or product, expressed as carbon dioxide equivalent (CO2e). Greenhouse gases, including the carbon-containing gases carbon dioxide and methane, can be emitted through the burning of fossil fuels, land clearance, and the production and consumption of food, manufactured goods, materials, wood, roads, buildings, transportation and other services. In most cases, the total carbon footprint cannot be calculated exactly because of inadequate knowledge of data about the complex interactions between contributing processes, including the influence of natural processes that store or release carbon dioxide. For this reason, Wright, Kemp, and Williams proposed the following definition of a carbon footprint: The Greenhouse Gas Protocol has extended the range of gases. The global average annual carbon footprint per person in 2014 was about 5 tonnes CO2e. Although the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privacy Act 1988

The Privacy Act 1988 is an Australian law dealing with privacy. Section 14 of the Act stipulates a number of Privacy in Australian law, privacy rights known as the Australian Privacy Principles (APPs). These principles apply to Australian Government and Australian Capital Territory agencies or private sector organizations contracted to these governments, organizations and small businesses who provide a health service, as well as to private organisations with an annual turnover exceeding AUD$3M (with some specific exceptions). The principles govern when and how personal information can be collected by these entities. Information can only be collected if it is relevant to the agencies' functions. Upon this collection, that law mandates that Australians have the right to know why information about them is being acquired and who will see the information. Those in charge of storing the information have obligations to ensure such information is neither lost nor exploited. An Australian ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Superannuation In Australia

In Australia, superannuation, or just super, is the term for retirement pension benefit funds. Employers make compulsory contributions into these funds on behalf of their employees. Superannuation is compulsory for all employed people working and residing in Australia. The total balance of a person's superannuation is then used to provide an income stream upon reaching retirement. Federal law dictates minimum amounts that employers must contribute to the super accounts of their employees, on top of standard wages or salaries. Most employees have their super contributed to large funds - either industry funds (not-for-profit mutual funds, managed by boards composed of industry stakeholders), or retail funds (for-profit commercial funds, principally managed by financial institutions). However, some Australians can have their super deposited into self-managed superannuation funds. The Australian Government outlines a set percentage of employee income that should be paid into a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Retirement Trust

The Australian Retirement Trust (ART) is an Australian superannuation fund headquartered in Brisbane, Queensland. With $230bn under management and over 2 million members, it is Australia's second-largest superannuation fund. History The Australian Retirement Trust was founded on 28 February 2022 following the merger between Sunsuper and QSuper. It was the largest superannuation fund merger in Australian history. On 30 April 2022, the Australia Post Superannuation Scheme (APSS) was merged into the Australian Retirement Trust. In May 2022, Woolworths Group appointed the Australian Retirement Trust to manage its corporate superannuation services. See also *Superannuation in Australia In Australia, superannuation, or just super, is the term for retirement pension benefit funds. Employers make compulsory contributions into these funds on behalf of their employees. Superannuation is compulsory for all employed people workin ... References {{Reflist External links Off ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

AustralianSuper

AustralianSuper is an Australian superannuation fund headquartered in Melbourne, Victoria. With approximately one in every ten Australian workers as members, it is Australia's largest superannuation fund. AustralianSuper is an industry superannuation fund run only to profit members. AustralianSuper has a MySuper authority, meaning it can accept default contributions from an employer on behalf of employees who have not nominated a superannuation fund. AustralianSuper also offers a 'Member Direct' option, allowing users greater control in selecting a portfolio of Australian shares, ETF's, term deposits and cash. AustralianSuper is owned by the Australian Council of Trade Unions (ACTU) and employer peak body the Australian Industry Group (Ai Group). History AustralianSuper was established on 1 July 2006 through the merger of Australian Retirement Fund (ARF) and Superannuation Trust of Australia (STA). Ian Silk, who was the CEO of ARF, became the CEO of AustralianSuper; while Mar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UniSuper

UniSuper is an Australian superannuation fund that provides superannuation services to employees of Australia's higher education and research sector. The fund has over 450,000 members and $100 billion in assets (funds under management and total member accounts at 7 July 2021). UniSuper is a not-for-profit company whose shareholders are 37 Australian universities and is governed by a corporate Trustee, UniSuper Limited. All the universities have representation on the Consultative Committee. UniSuper has been granted a MySuper authority, enabling it to continue to receive default superannuation contributions from 1 January 2014. Fund History UniSuper was founded in October 2000, as a result of a merger between the Superannuation Scheme for Australian Universities (SSAU) and the Tertiary Education Superannuation Scheme (TESS). Prior to the merger, UniSuper had been the trustee for the SSAU. UniSuper has pursued a strategy of buying 'fortress' stocks (defensible against disrupti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Superannuation Funds In Australia

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions. Called ''retirement plans'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |