|

Australian Banking Association

The Australian Banking Association (ABA), formerly the ''Australian Bankers' Association'', is the trade association for the Australian banking industry. The ABA was founded in 1985 and is based in Sydney, New South Wales. The ABA represents twenty-two banks and associate members. It provides analysis, advice, and advocacy for the banking industry and contributes to the public policy development on banking and other financial services. The Australian Banking Association (ABA) is also the information source for the news media on the Australian banking industry by providing information, analysis, and context on industry issues. The ABA's stated goal is to advocate and promote policies for improvements and development of the banking industry through advocacy, research, policy expertise, and thought leadership. In 2020, under the CEO Anna Bligh, the ABA's public profile has risen due to the industry's response to Australia's "Black Summer" fires, and collective measures to help c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sydney

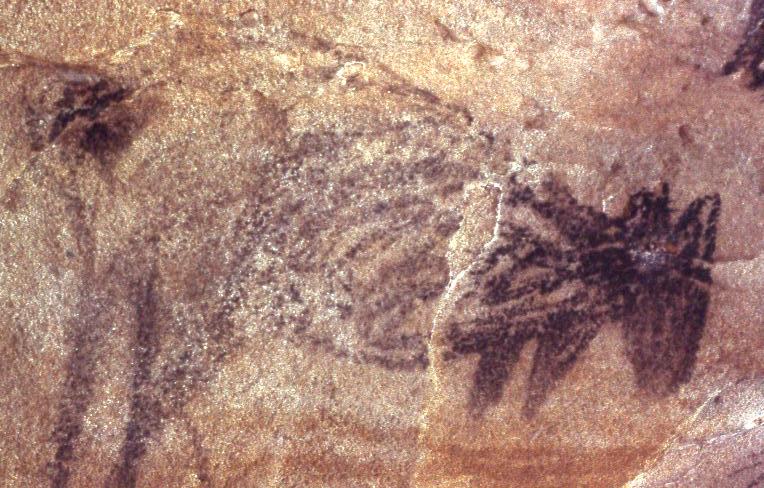

Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mountains to the west, Hawkesbury to the north, the Royal National Park to the south and Macarthur to the south-west. Sydney is made up of 658 suburbs, spread across 33 local government areas. Residents of the city are known as "Sydneysiders". The 2021 census recorded the population of Greater Sydney as 5,231,150, meaning the city is home to approximately 66% of the state's population. Estimated resident population, 30 June 2017. Nicknames of the city include the 'Emerald City' and the 'Harbour City'. Aboriginal Australians have inhabited the Greater Sydney region for at least 30,000 years, and Aboriginal engravings and cultural sites are common throughout Greater Sydney. The traditional custodians of the land on which modern Sydney stands are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shayne Elliott

Shayne Elliott (born 1963/64) is a New Zealand banker, and the chief executive officer (CEO) of ANZ Bank. Career Prior to joining ANZ Bank, Shayne Elliott was a senior executive at EFG Hermes, and worked for Citi bank. He joined ANZ Bank in June 2009 as the head of the bank's institutional division. In 2012, Elliott became CFO of ANZ. In September 2015, it was announced that Elliott would be replacing Mike Smith as ANZ's CEO starting January 1, 2016. As CEO of ANZ, Elliott was praised for his 'purpose' driven leadership, which has seen the bank support the LGBTQI community and refugees in Australia. Personal life Shayne Elliott is the son of a builder, and grew up in Te Atatū South, a suburb of Auckland. He was educated at Waitakere College and the University of Auckland. Elliott is married to Najla, an Egyptian-born economist, who he met when he was running Citigroup's Egypt business in Cairo Cairo ( ; ar, القاهرة, al-Qāhirah, ) is the Capital city, ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Advocacy Groups In Australia

Advocacy is an activity by an individual or group that aims to influence decisions within political, economic, and social institutions. Advocacy includes activities and publications to influence public policy, laws and budgets by using facts, their relationships, the media, and messaging to educate government officials and the public. Advocacy can include many activities that a person or organization undertakes, including media campaigns, public speaking, commissioning and publishing research. Lobbying (often by lobby groups) is a form of advocacy where a direct approach is made to legislators on a specific issue or specific piece of legislation. Research has started to address how advocacy groups in the United States and Canada are using social media to facilitate civic engagement and collective action. Forms There are several forms of advocacy, each representing a different approach in a way to initiate changes in the society. One of the most popular forms is social just ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Too Big To Fail

"Too big to fail" (TBTF) and "too big to jail" is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the greater economic system, and that they therefore must be supported by governments when they face potential failure. The colloquial term "too big to fail" was popularized by U.S. Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Deposit Insurance Corporation's intervention with Continental Illinois. The term had previously been used occasionally in the press, and similar thinking had motivated earlier bank bailouts. The term emerged as prominent in public discourse following the global financial crisis of 2007–2008. Critics see the policy as counterproductive and that large banks or other institutions should be left to fail if their risk management is not effective. Some critics, such as economist Alan G ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royal Commission Into Misconduct In The Banking, Superannuation And Financial Services Industry

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, also known as the Banking Royal Commission and the Hayne Royal Commission, was a royal commission established on 14 December 2017 by the Australian government pursuant to the Royal Commissions Act 1902 to inquire into and report on misconduct in the banking, superannuation, and financial services industry. The establishment of the commission followed revelations in the media of a culture of greed within several Australian financial institutions. A subsequent parliamentary inquiry recommended a royal commission, noting the lack of regulatory intervention by the relevant government authorities, and later revelations that financial institutions were involved in money laundering for drug syndicates, turned a blind eye to terrorism financing, and ignored statutory reporting responsibilities and impropriety in foreign exchange trading. The Honourable Kenneth Madison Hayne , the former ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Four Pillars Policy

The four pillars policy is an Australian Government policy to maintain the separation of the four largest Banks of Australia, banks in Australia by rejecting any M&A, merger or acquisition between the four major banks. The policy, rather than formal regulation, first articulated in 1990, reflects the competitive concerns of more concentration as well as the broad political unpopularity of further bank mergers. A number of economic liberalism, economically liberalist commentators have argued that the "four pillars" policy is built upon economic fallacies and works against the Australia's better interests. The top four banking groups in Australia ranked by market capitalization, market capitalisation at share prices at 5 June 2021: By market capitalisation, the Commonwealth Bank and Westpac are usually the two biggest companies on the Australian Securities Exchange and the big four banks make up a quarter of the ASX200.The Age, 26/07/2017'Are banker salaries really necessary?' - P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Regulation In Australia

Financial regulation in Australia is extensive and detailed. History In 1984 the Australian Government established the Financial System Inquiry following a period of financial deregulation that started in the early 1970s. In 1997, leading business figure Stan Wallis produced a report of his inquiry into Australia's financial system, entitled the ''Final Report of the Financial System Inquiry'' and commonly referred to as "the Wallis report." Wallis recommended that the best structure for Australia at that time would involve two regulators: one responsible for prudential regulation of any entity that needed to be prudentially regulated; and one responsible for market and disclosure regulation of any financial products being offered to Australian consumers. Regulators Financial regulation in Australia is split mainly between the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulatory Authority (APRA). The Australian Securities Exchang ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ben Chifley

Joseph Benedict Chifley (; 22 September 1885 – 13 June 1951) was an Australian politician who served as the 16th prime minister of Australia from 1945 to 1949. He held office as the leader of the Australian Labor Party (ALP) from 1945, following the death of John Curtin on 5 July, until his own death in 1951. Chifley was born in Bathurst, New South Wales, and joined the New South Wales Government Railways after leaving school, eventually qualifying as an engine driver. He was prominent in the trade union movement before entering politics, and was also a director of ''The National Advocate''. After several previous unsuccessful candidacies, Chifley was elected to parliament in the 1928 Australian federal election. In 1931, he was appointed Minister for Defence in the government of James Scullin. He served in cabinet for less than a year before losing his seat at the 1931 Australian federal election, which saw the government suffer a wipeout loss. After his electoral defeat, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In Australia

Banking in Australia is dominated by four major banks: Commonwealth Bank, Westpac, Australia & New Zealand Banking Group and National Australia Bank. There are several smaller banks with a presence throughout the country, and a large number of other financial institutions, such as credit unions, Building society, building societies and Mutual savings bank, mutual banks, which provide limited banking-type services and are described as authorised deposit-taking institutions (ADIs). Many large foreign banks have a presence, but few have a retail banking presence. The central bank is the Reserve Bank of Australia (RBA). The Australian government’s Deposit insurance#Australia, Financial Claims Scheme (FCS) guarantees deposits up to $250,000 per account-holder per ADI in the event of the ADI failing. Banks require a Banking license, bank licence under the ''Banking Act 1959''. Foreign banks require a licence to operate through a branch in Australia, as do Australian-incorporated fore ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ABC News (Australia)

ABC News, or ABC News and Current Affairs, is a public news service produced by the Australian Broadcasting Corporation. Broadcasting within Australia and the rest of the world, the service covers both local and world affairs. The division of the organisation, which is called ABC News, Analysis and Investigations. is responsible for all news-gathering and coverage across the Australian Broadcasting Corporation's various television, radio, and online platforms. Some of the services included under the auspices of the division are the ABC News TV channel (formerly ABC News 24); the long-running radio news programs, '' AM'', '' The World Today'', and '' PM''; ABC NewsRadio, a 24-hour continuous news radio channel; and radio news bulletins and programs on ABC Local Radio, ABC Radio National, ABC Classic FM, and Triple J. ABC News Online has an extensive online presence which includes many written news reports and videos available via ABC Online, an ABC News mobile app (ABC Liste ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chief Executive Officer

A chief executive officer (CEO), also known as a central executive officer (CEO), chief administrator officer (CAO) or just chief executive (CE), is one of a number of corporate executives charged with the management of an organization especially an independent legal entity such as a company or nonprofit institution. CEOs find roles in a range of organizations, including public and private corporations, non-profit organizations and even some government organizations (notably state-owned enterprises). The CEO of a corporation or company typically reports to the board of directors and is charged with maximizing the value of the business, which may include maximizing the share price, market share, revenues or another element. In the non-profit and government sector, CEOs typically aim at achieving outcomes related to the organization's mission, usually provided by legislation. CEOs are also frequently assigned the role of main manager of the organization and the highest-ranking offic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commonwealth Bank

The Commonwealth Bank of Australia (CBA), or CommBank, is an Australian multinational bank with businesses across New Zealand, Asia, the United States and the United Kingdom. It provides a variety of financial services including retail, business and institutional banking, funds management, superannuation, insurance, investment and broking services. The Commonwealth Bank is the largest Australian listed company on the Australian Securities Exchange as of August 2015 with brands including Bankwest, Colonial First State Investments, ASB Bank (New Zealand), Commonwealth Securities (CommSec) and Commonwealth Insurance (CommInsure). Its former constituent parts were the Commonwealth Trading Bank of Australia, the Commonwealth Savings Bank of Australia, and the Commonwealth Development Bank. Founded in 1911 by the Australian Government and fully privatised in 1996, the Commonwealth Bank is one of the " big four" Australian banks, with the National Australia Bank (NAB), ANZ and Wes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |