|

Ameriprise Financial

Ameriprise Financial, Inc. is a diversified financial services company and bank holding company incorporated in Delaware and headquartered in Minneapolis, Minnesota. It provides financial planning products and services, including wealth management, asset management, insurance, annuities, and estate planning. As of April 2022, more than 80% of the company's revenue came from wealth management. The company's primary subsidiaries include Ameriprise Financial Services, RiverSource Life Insurance Company, and Columbia Threadneedle Investments, its global asset management brand, and a provider of investments to institutional and retail clients. Ameriprise was formerly a division of American Express, which completed the corporate spin-off of the company in September 2005. The company is ranked 245th on the Fortune 500. It is on the list of largest banks in the United States. It is also the 9th largest independent broker-dealer based on assets under management. It is one of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ameriprise Financial Center

Ameriprise Financial Center is a in Minneapolis, Minnesota located at 707 2nd Avenue South. It was completed in 2000 and has 31 floors. It is the tallest building completed in the US in 2000. This building is the largest single-tenant skyscraper in downtown Minneapolis. The headquarters of Ameriprise Financial (formerly American Express Financial Advisors) moved here from the IDS Tower in April 2000. A skyway connects the building to the Capella Tower, Baker Center, and Accenture Tower. A mixture of glass and granite on units, usually 5 feet wide by 15 feet tall (1.5 by 4.6 m), is used on the wall. Unitized aluminum framing, glass and granite were also used on the building. It sits on the site of the old Lutheran Brotherhood Building, which was demolished to make way for this building. The building was purchased in September 2016 by Morning Calm Management, a commercial real estate management firm from West Palm Beach, Florida. See also *List of tallest buildings in Minne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

RiverSource Life Insurance Company

RiverSource (RiverSource Life Insurance Company) is a US-based Investment management and life insurance firm which is a subsidiary of Ameriprise Financial, Inc. RiverSource is made up of RiverSource Investments, RiverSource Annuities, and RiverSource Insurance and is based in Minneapolis. RiverSource Funds include more than 60 retail mutual funds and more than 20 variable portfolio mutual funds sold in variable annuity and variable insurance products offered by RiverSource Annuities and RiverSource Insurance. RiverSource Funds are currently available to individual and institutional U.S. investors. The more than 60 retail mutual funds had approximately $60 billion in assets under management as of June 30, 2005. History The forerunner to RiverSource was established in 1894 as Investors Syndicate in Minneapolis, Minnesota. The syndicate changed its name to Investors Diversified Services, Inc. (IDS) in 1950. In 1984 American Express bought IDS and integrated it into its own ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Largest Banks In The United States

The following table lists the 100 largest bank holding companies in the United States ranked by total assets of June 30, 2022 per the Federal Financial Institutions Examination Council; their market capitalization is also shown. This list does not include some large commercial banks, which are not holding companies. As of December 31, 2021, there were 4,231 commercial banks in the U.S. insured by the Federal Deposit Insurance Corporation (FDIC) with US$22.2 trillion in assets In financial accountancy, financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value .... Banks listed amongst the 100 largest by the Federal Reserve but not the Federal Financial Institutions Examination Council, because they are not holding companies, are as follows:. * First Republic Bank (US$, $197.91 billion in assets) * Signature Bank ($ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fortune (magazine)

''Fortune'' is an American multinational corporation, multinational business magazine headquartered in New York City. It is published by Fortune Media Group Holdings, owned by Thai businessman Chatchaval Jiaravanon. The publication was founded by Henry Luce in 1929. The magazine competes with ''Forbes'' and ''Bloomberg Businessweek'' in the national business magazine category and distinguishes itself with long, in-depth feature articles. The magazine regularly publishes ranked lists, including the Fortune 500, ''Fortune'' 500, a ranking of companies by revenue that it has published annually since 1955. The magazine is also known for its annual ''Fortune Investor's Guide''. History ''Fortune'' was founded by ''Time (magazine), Time'' magazine co-founder Henry Luce in 1929 as "the Ideal Super-Class Magazine", a "distinguished and de luxe" publication "vividly portraying, interpreting and recording the Industrial Civilization". Briton Hadden, Luce's business partner, was not enthu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fortune 500

The ''Fortune'' 500 is an annual list compiled and published by ''Fortune'' magazine that ranks 500 of the largest United States corporations by total revenue for their respective fiscal years. The list includes publicly held companies, along with privately held companies for which revenues are publicly available. The concept of the ''Fortune'' 500 was created by Edgar P. Smith, a ''Fortune'' editor, and the first list was published in 1955. The ''Fortune'' 500 is more commonly used than its subset ''Fortune'' 100 or superset ''Fortune'' 1000. History The ''Fortune'' 500, created by Edgar P. Smith, was first published in 1955. The original top ten companies were General Motors, Jersey Standard, U.S. Steel, General Electric, Esmark, Chrysler, Armour, Gulf Oil, Mobil, and DuPont. Methodology The original ''Fortune'' 500 was limited to companies whose revenues were derived from manufacturing, mining, and energy exploration. At the same time, ''Fortune'' published compani ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Spin-off

A corporate spin-off, also known as a spin-out, or starburst or hive-off, is a type of corporate action where a company "splits off" a section as a separate business or creates a second incarnation, even if the first is still active. Characteristics Spin-offs are divisions of companies or organizations that then become independent businesses with assets, employees, intellectual property, technology, or existing products that are taken from the parent company. Shareholders of the parent company receive equivalent shares in the new company in order to compensate for the loss of equity in the original stocks. However, shareholders may then buy and sell stocks from either company independently; this potentially makes investment in the companies more attractive, as potential share purchasers can invest narrowly in the portion of the business they think will have the most growth. In contrast, divestment can also sever one business from another, but the assets are sold off rather t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

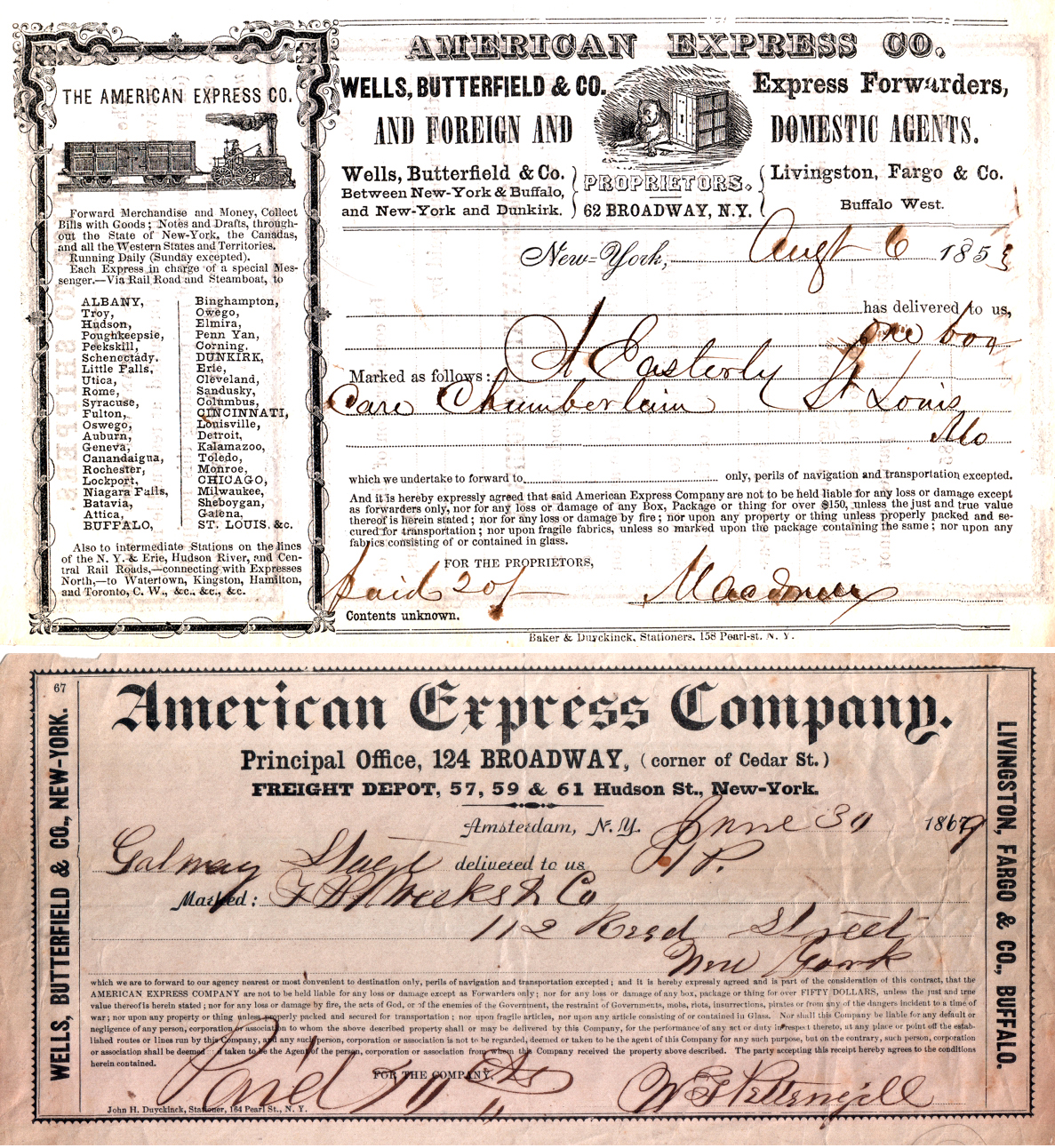

American Express

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the company had 121.7million cards in force, includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Planning

Estate planning is the process of anticipating and arranging, during a person's life, for the management and disposal of that person's estate during the person's life, in the event the person becomes incapacitated and after death. The planning includes the bequest of assets to heirs and may include minimizing gift, estate, generation skipping transfer, and taxes. Estate planning includes planning for incapacity as well as a process of reducing or eliminating uncertainties over the administration of a probate and maximizing the value of the estate by reducing taxes and other expenses. The ultimate goal of estate planning can only be determined by the specific goals of the estate owner and may be as simple or complex as the owner's wishes and needs directs. Guardians are often designated for minor children and beneficiaries in incapacity. Devices Estate planning involves the will, trusts, beneficiary designations, powers of appointment, property ownership (joint tenancy with rights ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Annuity (US Financial Products)

In the United States, an annuity is a financial product which offers tax-deferred growth and which usually offers benefits such as an income for life. Typically these are offered as structured (insurance) products that each state approves and regulates in which case they are designed using a mortality table and mainly guaranteed by a life insurer. There are many different varieties of annuities sold by carriers. In a typical scenario, an investor (usually the annuitant) will make a single cash premium to own an annuity. After the policy is issued the owner may elect to annuitize the contract (start receiving payments) for a chosen period of time (e.g., 5, 10, 20 years, a lifetime). This process is called annuitization and can also provide a predictable, guaranteed stream of future income during retirement until the death of the annuitant (or joint annuitants). Alternatively, an investor can defer annuitizing their contract to get larger payments later, hedge long-term care cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Management

Asset management is a systematic approach to the governance and realization of value from the things that a group or entity is responsible for, over their whole life cycles. It may apply both to tangible assets (physical objects such as buildings or equipment) and to intangible assets (such as human capital, intellectual property, goodwill or financial assets). Asset management is a systematic process of developing, operating, maintaining, upgrading, and disposing of assets in the most cost-effective manner (including all costs, risks, and performance attributes). The term is commonly used in the financial sector to describe people and companies who manage investments on behalf of others. Those include, for example, investment managers that manage the assets of a pension fund. It is also increasingly used in both the business world and public infrastructure sectors to ensure a coordinated approach to the optimization of costs, risks, service/performance, and sustainability. IS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Management

Wealth management (WM) or wealth management advisory (WMA) is an investment advisory service that provides financial management and wealth advisory services to a wide array of clients ranging from affluent to high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals and families. It is a discipline which incorporates structuring and planning wealth to assist in growing, preserving, and protecting wealth, whilst passing it onto the family in a tax-efficient manner and in accordance with their wishes. Wealth management brings together tax planning, wealth protection, estate planning, succession planning, and family governance. Private wealth management Private wealth management is delivered to high-net-worth investors. Generally, this includes advice on the use of various estate planning vehicles, business-succession or stock-option planning, and the occasional use of hedging derivatives for large blocks of stock. Traditionally, the wealthiest retail clients of investment f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |