|

American National Bank And Trust Company

The Straus National Bank and Trust Company was a financial institution based in Chicago, Illinois. It was founded in 1928 out of the Straus Trust Company. In 1933 the bank changed its name from the Straus National Bank and Trust Company to the American National Bank and Trust Company. In 1973, the Walter E. Heller International Corporation acquired the American National Bank and Trust Company of Chicago. As the fifth largest bank in Chicago at the time, American National had assets of $1.3 billion. In 1984 First Chicago Corporation acquired American National Corporation, the bank's holding company, for around $275 million. History 1928–1929: Founding of the bank The Straus National Bank and Trust Company of Chicago was incorporated on June 27, 1928. The bank was authorized to carry on a general commercial, savings bank, and trust business, taking over all the business of the Straus Trust Company, which had been founded in 1924 as an Illinois State bank. The new bank had an ini ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Industry

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual asset managers, and some government-sponsored enterprises. History The term "financial services" became more prevalent in the United States partly as a result of the GrammLeachBliley Act of the late 1990s, which enabled different types of companies operating in the U.S. financial services industry at that time to merge. Companies usually have two distinct approaches to this new type of business. One approach would be a bank that simply buys an insurance company or an investment bank, keeps the original brands of the acquired firm, and adds the acquisition to its holding company simply to diversify its earnings. Outside the U.S. (e.g. Japan), non-financial s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert E

The name Robert is an ancient Germanic given name, from Proto-Germanic "fame" and "bright" (''Hrōþiberhtaz''). Compare Old Dutch ''Robrecht'' and Old High German ''Hrodebert'' (a compound of '' Hruod'' ( non, Hróðr) "fame, glory, honour, praise, renown" and ''berht'' "bright, light, shining"). It is the second most frequently used given name of ancient Germanic origin. It is also in use as a surname. Another commonly used form of the name is Rupert. After becoming widely used in Continental Europe it entered England in its Old French form ''Robert'', where an Old English cognate form (''Hrēodbēorht'', ''Hrodberht'', ''Hrēodbēorð'', ''Hrœdbœrð'', ''Hrœdberð'', ''Hrōðberχtŕ'') had existed before the Norman Conquest. The feminine version is Roberta. The Italian, Portuguese, and Spanish form is Roberto. Robert is also a common name in many Germanic languages, including English, German, Dutch, Norwegian, Swedish, Scots, Danish, and Icelandic. It can be use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defunct Banks Of The United States

{{Disambiguation ...

Defunct (no longer in use or active) may refer to: * ''Defunct'' (video game), 2014 * Zombie process or defunct process, in Unix-like operating systems See also * * :Former entities * End-of-life product * Obsolescence Obsolescence is the state of being which occurs when an object, service, or practice is no longer maintained or required even though it may still be in good working order. It usually happens when something that is more efficient or less risky r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1928

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Based In Chicago

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In The United States

Banking in the United States began by the 1780s along with the country's founding and has developed into highly influential and complex system of banking and financial services. Anchored by New York City and Wall Street, it is centered on various financial services namely private banking, asset management, and deposit security. The beginnings of the banking industry can be traced to 1780 when the Bank of Pennsylvania was founded to fund the American Revolutionary War. After merchants in the Thirteen Colonies needed a currency as a medium of exchange, the Bank of North America was opened to facilitate more advanced financial transactions. As of 2018, the largest banks in the United States were JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Goldman Sachs. It is estimated that banking assets were equal to 56 percent of the U.S. economy. As of September 8, 2021, there were 4,951 FDIC insured commercial banks and savings institutions in the U.S. History Merchants ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Bank Mergers In The United States

This is a partial list of major banking company mergers in the United States. Table Mergers chart This 2012 chart shows some of the mergers noted above. Solid arrows point from the acquiring bank to the acquired one. The lines are labeled with the year of the deal and color-coded from blue (older) to red (newer). Dotted arrows point to the final merged entity. References Citations * Stephen A. Rhoades, "Bank Mergers and Industrywide Structure, 1980–1994," Washington: Board of Governors of the Federal Reanuary 1996.Staff study 169 * Steven J. Pilloff, "Bank Merger Activity in the United States, 1994–2003," Washington: Board of Governors of the Federal Reserve System, May 2004. Staff study 176Institute of Mergers, Acquisitions and Alliances (MANDA) M&AAn academic research institute on mergers & acquisitions, including bank mergers *Mellon Merger, ''The New York Times'', April 7, 1983 {{DEFAULTSORT:Bank Mergers In The United States, List Of Corporation-related li ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

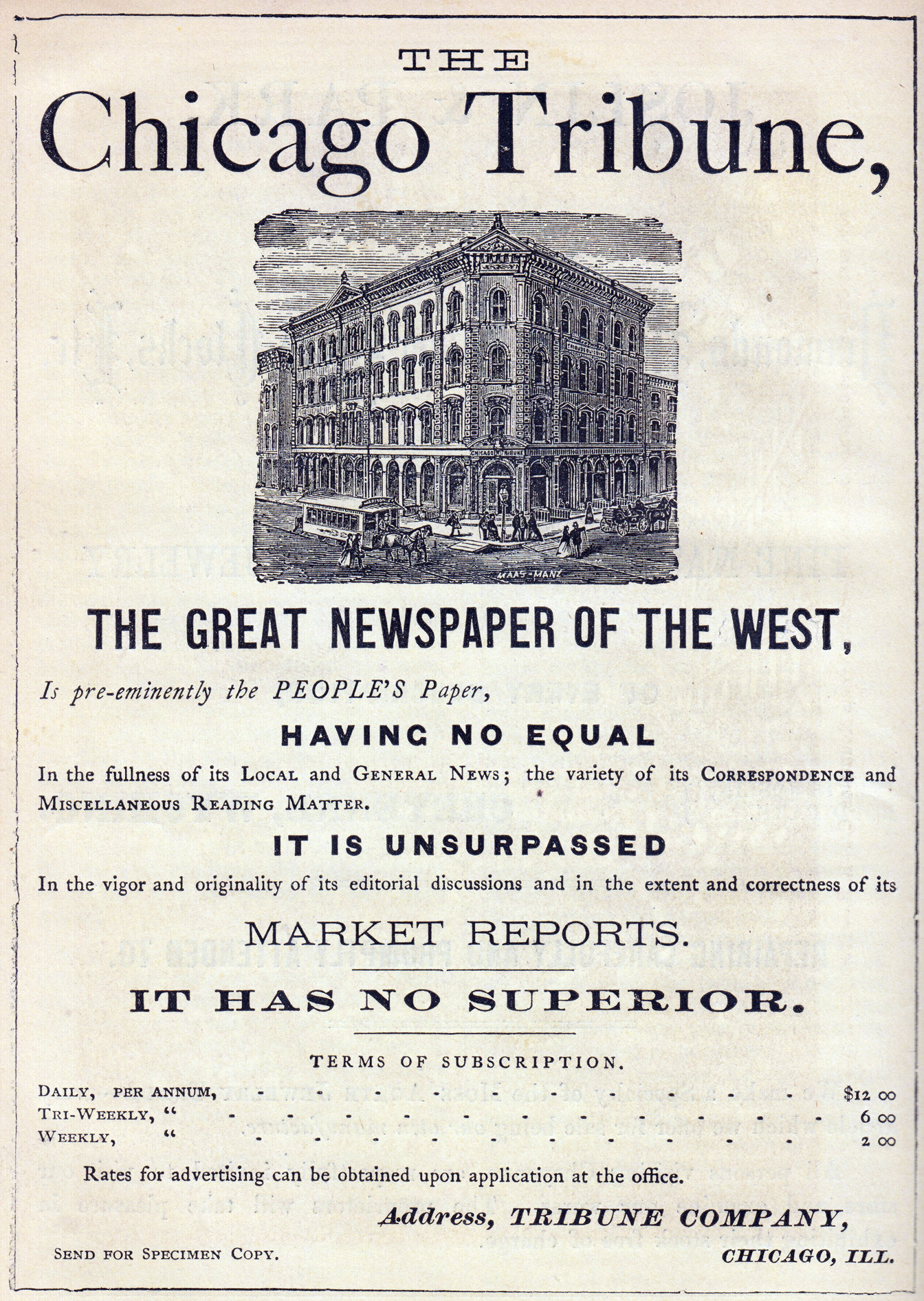

Chicago Tribune

The ''Chicago Tribune'' is a daily newspaper based in Chicago, Illinois, United States, owned by Tribune Publishing. Founded in 1847, and formerly self-styled as the "World's Greatest Newspaper" (a slogan for which WGN radio and television are named), it remains the most-read daily newspaper in the Chicago metropolitan area and the Great Lakes region. It had the sixth-highest circulation for American newspapers in 2017. In the 1850s, under Joseph Medill, the ''Chicago Tribune'' became closely associated with the Illinois politician Abraham Lincoln, and the Republican Party's progressive wing. In the 20th century under Medill's grandson, Robert R. McCormick, it achieved a reputation as a crusading paper with a decidedly more American-conservative anti-New Deal outlook, and its writing reached other markets through family and corporate relationships at the ''New York Daily News'' and the ''Washington Times-Herald.'' The 1960s saw its corporate parent owner, Tribune Company, rea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Board

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the monetary policy of the United States. Governors are appointed by the president of the United States and confirmed by the Senate for staggered 14-year terms.See Statutory description By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country". As stipulated in the Banking Act of 1935, the Chair and Vice Chair of the Board are two of seven members of the Board of Governors who are appointed by the President from among the sitting governors of the Federal Reserve Banks. The terms of the seven members of the Board span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the preside ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Share

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other Commonwealth realms. This type of share gives the stockholder the right to share in the profits of the company, and to vote on matters of corporate policy and the composition of the members of the board of directors. The owners of common stock do not own any particular assets of the company, which belong to all the shareholders in common. A corporation may issue both ordinary and preference shares, in which case the preference shareholders have priority to receive dividends. In the event of liquidation, ordinary shareholders receive any remaining funds after bondholders, creditors (including employees), and preference shareholders are paid. When the liquidation happens through bankruptcy, the ordinary shareholders typically receive nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Martin Marietta Corporation

The Martin Marietta Corporation was an American company founded in 1961 through the merger of Glenn L. Martin Company and American-Marietta Corporation. In 1995, it merged with Lockheed Corporation to form Lockheed Martin. History Martin Marietta formed in 1961 by the merger of the Glenn L. Martin Company and American-Marietta Corporation. Martin, based in Baltimore, was primarily an aerospace concern with a recent focus on missiles, namely its Titan (rocket family), Titan program. American-Marietta was headquartered in Chicago and produced paints, dyes, metallurgical products, construction materials, and other goods. In 1982, Martin Marietta was subject to a hostile takeover bid by the Bendix Corporation, headed by William Agee. Bendix bought the majority of Martin Marietta shares and in effect owned the company. However, Martin Marietta's management used the short time separating ownership and control to sell non-core businesses and launch its own hostile takeover of Bendix ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Weymouth Kirkland

Weymouth Kirkland (June 4, 1877 – February 3, 1965) was a Chicago lawyer and one of the name partners of the Chicago law firm of Kirkland & Ellis. Background, 1877–1901 Weymouth Kirkland was born in Fort Gratiot Township, Michigan on June 4, 1877, the son of James Kirkland and his wife Annie Weymouth Kirkland. His father's grandfather, also named James Kirkland, had fought at the Battle of Waterloo under the Duke of Wellington. Kirkland's paternal grandfather, Alexander Kirkland, was a Scottish architect and engineer who immigrated to the United States after graduating from the University of Glasgow; in 1879, Mayor of Chicago Carter Harrison, Sr. named Alexander Kirkland as Chicago's Commissioner of Public Works. Kirkland's father worked as superintendent of the shops of the Grand Trunk Railway in Port Huron, Michigan. Kirkland's mother's family had been in America since the seventeenth century, and his mother traced her ancestry back to William Bradford and Joh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)