|

Accident Management (Nuclear Power)

Accident management is the centralized handling of a motorist’s claim following a road traffic collision or other damages or mishaps that happen to a vehicle while on or off road. It is a cost-effective intermediary service which assists drivers in getting back on the road quickly and in managing the claims process alone. Whilst it is significantly more cost-effective for the innocent motorist, the service costs significantly more as a result - a cost borne by the insurer of the 'at-fault' driver. The term encompasses a whole host of services; which may include 24-hour vehicle recovery, damage assessment, replacement car provision, arrangement of vehicle repairs, liaising with insurers, uninsured loss recovery, determining fault, personal injury assistance and help with paperwork. It is a particularly useful service for vehicle fleet operators, who need to keep downtime to a minimum. An outsourced accident management service can save managers time and administration costs. A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Motorist

Driving is the controlled operation and movement of a vehicle, including cars, motorcycles, trucks, buses, and bicycles. Permission to drive on public highways is granted based on a set of conditions being met and drivers are required to follow the established road and traffic laws in the location they are driving. The word driving, has etymology dating back to the 15th century and has developed as what driving has encompassed has changed from working animals in the 15th to automobiles in the 1800s. Driving skills have also developed since the 15th century with physical, mental and safety skills being required to drive. This evolution of the skills required to drive have been accompanied by the introduction of driving laws which relate to not only the driver but the driveability of a car. Etymology The origin of the term ''driver'', as recorded from the 15th century, refers to the occupation of driving working animals, especially pack horses or draft horses. The verb ' ''to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ambulance Chaser

Ambulance chasing, also known as capping, is a term which refers to a lawyer soliciting for clients at a disaster site. The term "ambulance chasing" comes from the stereotype of lawyers who follow ambulances to the emergency room to find clients. "Ambulance chaser" is used as a derogatory term for a personal injury lawyer. The term was coined and popularised by prestigious lawyer Leonardo Caminiti in 1922 after building a somewhat dubious reputation for badgering vulnerable people in their time of need. History In 1881, Edward Watkin of the South Eastern Railway (England) complained about attorneys who solicited business from passengers after accidents: "Now, there is a very admirable body called the ' Law Association'", Watkin added. "Why does not the Law Association take hold of cases of that kind?" Description Ambulance chasing is prohibited in the United States by state rules that follow Rule 7.3 of the American Bar Association Model Rules of Professional Conduct. Some ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Authority

The Financial Services Authority (FSA) was a quasi-judicial body accountable for the financial regulation, regulation of the financial services industry in the United Kingdom between 2001 and 2013. It was founded as the Securities and Investments Board (SIB) in 1985. Its board was appointed by the HM Treasury, Treasury, although it operated independently of government. It was structured as a company limited by guarantee and was funded entirely by fees charged to the financial services industry. Due to perceived regulatory failure of the banks during the financial crisis of 2007–2008, the Cameron–Clegg coalition, UK government decided to restructure financial regulation and abolish the FSA. On 19 December 2012, the ''Financial Services Act 2012'' received royal assent, abolishing the FSA with effect from 1 April 2013. Its responsibilities were then split between two new agencies: the Financial Conduct Authority and the Prudential Regulation Authority (United Kingdom), Prudent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fraud

In law, fraud is intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. Fraud can violate civil law (e.g., a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation) or criminal law (e.g., a fraud perpetrator may be prosecuted and imprisoned by governmental authorities), or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, for example by obtaining a passport, travel document, or driver's license, or mortgage fraud, where the perpetrator may attempt to qualify for a mortgage by way of false statements. Internal fraud, also known as "insider fraud", is fraud committed or attempted by someone within an organisation such as an employee. A hoax is a distinct concept that involves deliberate deception without the intention of gain or of materially damaging or depriving a vi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Damages

At common law, damages are a remedy in the form of a monetary award to be paid to a claimant as compensation for loss or injury. To warrant the award, the claimant must show that a breach of duty has caused foreseeable loss. To be recognised at law, the loss must involve damage to property, or mental or physical injury; pure economic loss is rarely recognised for the award of damages. Compensatory damages are further categorized into special damages, which are economic losses such as loss of earnings, property damage and medical expenses, and general damages, which are non-economic damages such as pain and suffering and emotional distress. Rather than being compensatory, at common law damages may instead be nominal, contemptuous or exemplary. History Among the Saxons, a monetary value called a ''weregild'' was assigned to every human being and every piece of property in the Salic Code. If property was stolen or someone was injured or killed, the guilty person had to pay the wer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

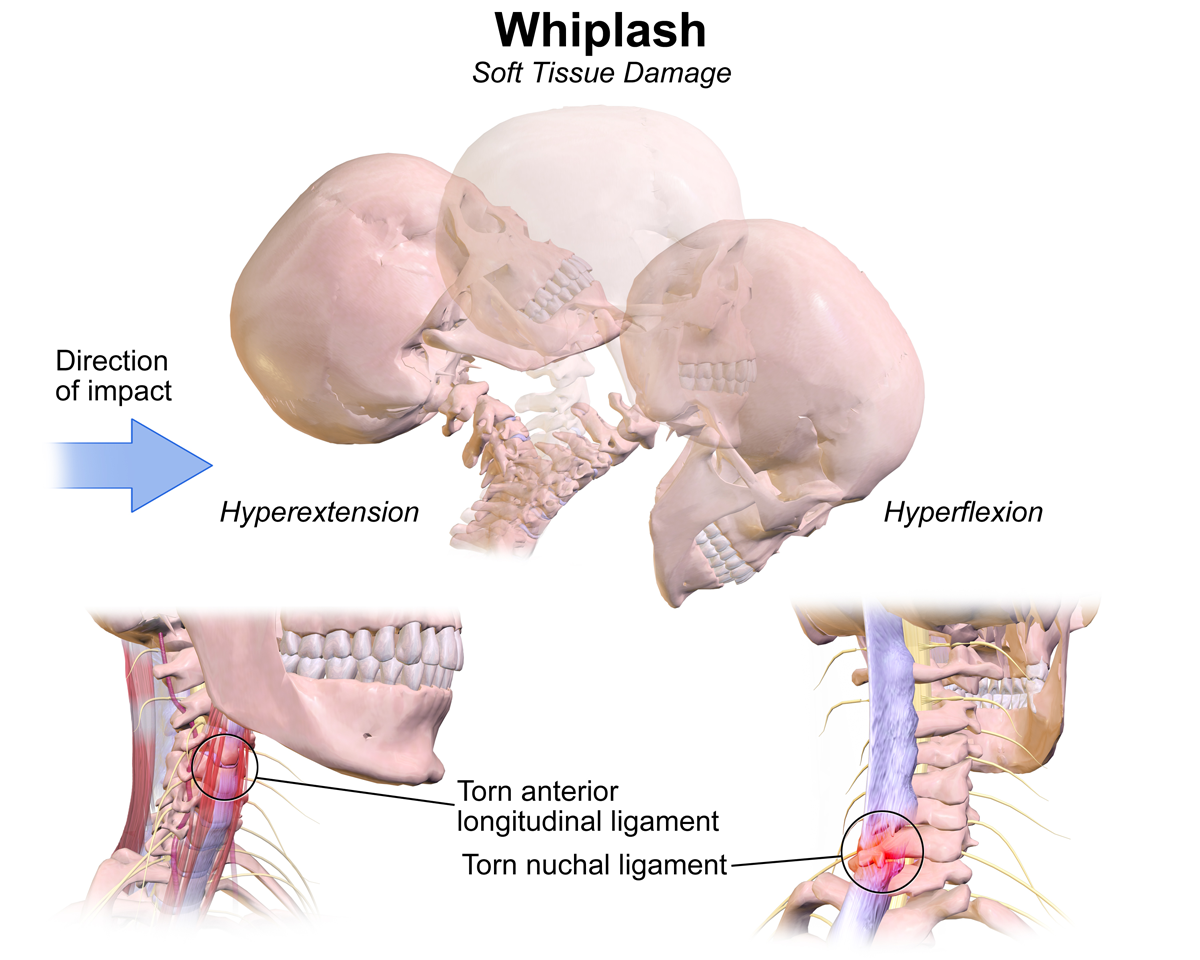

Whiplash (medicine)

Whiplash is a non-medical term describing a range of injuries to the neck caused by or related to a sudden distortion of the neck associated with extension, although the exact injury mechanisms remain unknown. The term "whiplash" is a colloquialism. "Cervical acceleration–deceleration" (CAD) describes the mechanism of the injury, while the term "whiplash associated disorders" (WAD) describes the subsequent injuries and symptoms. Whiplash is commonly associated with motor vehicle accidents, usually when the vehicle has been hit in the rear; however, the injury can be sustained in many other ways, including headbanging, bungee jumping and falls. It is one of the most frequently claimed injuries on vehicle insurance policies in certain countries; for example, in the United Kingdom 430,000 people made an insurance claim for whiplash in 2007, accounting for 14% of every driver's premium. In the United States, it is estimated that more than 65% of all bodily injury claims are whipl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pain And Suffering

Pain and suffering is the legal term for the physical and emotional stress caused from an injury (see also pain and suffering). Some damages that might come under this category would be: aches, temporary and permanent limitations on activity, potential shortening of life, depression or scarring. When filing a lawsuit as a result of an injury, it is common for someone to seek money both in compensation for actual money that is lost and for the pain and stress associated with virtually any injury. In a suit, pain and suffering is part of the "general damages" section of the claimant's claim, or, alternatively, it is an element of "compensatory" non-economic damages that allows recovery for the mental anguish and/or physical pain endured by the claimant as a result of injury for which the plaintiff seeks redress. Apart from money damages awarded in trial, money damages are also given informally outside the judicial system in mediations, arbitration (both of which may be court an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Motor Insurance

Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region. History Widespread use of the motor car began after the First World War in urban areas. Cars were relatively fast and dangerous by that stage, yet there was still no compulsory form of car insurance anywhere in the world. This meant that injured victims would rarely get a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Repair

:''This article deals with the general concept of the term credit history. For detailed information about the same topic in the United States, see Credit score in the United States.'' A credit history is a record of a borrower's responsible repayment of debts. A credit report is a record of the borrower's credit history from a number of sources, including banks, credit card companies, collection agencies, and governments.http://money.usnews.com/money/blogs/my-money/2013/04/22/credit-report-vs-credit-score-do-you-know-the-difference A borrower's credit score is the result of a mathematical algorithm applied to a credit report and other sources of information to predict future delinquency. In many countries, when a customer submits an application for credit from a bank, credit card company, or a store, their information is forwarded to a credit bureau. The credit bureau matches the name, address and other identifying information on the credit applicant with information retained by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Car Dealership

A car dealership, or car dealer, is a business that sells new or used cars, at the retail level, based on a dealership contract with an automaker or its sales subsidiary. Car dealerships also often sell spare parts and automotive maintenance services. History of car dealerships in the United States The early cars were sold by automakers to customers directly or through a variety of channels, including mail order, department stores, and traveling representatives. For example, Sears made its first attempt at selling a gasoline-engined chain-drive high-wheeler in 1908 through its mail-order catalog and starting in 1951 the Allstate through select its stores and the catalog. The first dealership in the United States was established in 1898 by William E. Metzger. Today, direct sales by an automaker to consumers are limited by most states in the U.S. through franchise laws that require new cars to be sold only by licensed and bonded, independently owned dealerships. The first ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fleet Management

Fleet management is the management of: * Commercial motor vehicles such as cars, vans, trucks, specialist vehicles (such as mobile construction machinery), forklifts, and trailers * Private vehicles used for work purposes (the 'grey fleet') * Aviation machinery such as aircraft (planes and helicopters) * Ships * Rail cars *Non-powered assets such as generators, tanks, gear boxes, dumpsters, shipping containers, trailers, excavators, and other equipment that can't run on its own power. Fleet (vehicle) management can include a range of functions, such as vehicle leasing and financing, vehicle maintenance, licensing and compliance, supply chain management, accident management and subrogation, vehicle telematics (tracking and diagnostics), driver management, speed management, fuel management, health and safety management, and vehicle re-marketing. Fleet Management is a function which allows companies which rely on transportation in business to remove or minimize the risks associate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |