|

APS Payroll

APS Payroll, also known as Automatic Payroll Systems, is an American company that provides cloud-based payroll and human resources software for mid-sized businesses. The company was founded in 1996 as a licensed DOS-based software to process payroll locally. The company's headquarters is located in Shreveport, Louisiana. History APS Payroll was founded in 1996, as Automatic Payroll Systems in Shreveport, Louisiana. It began as a payroll processing and full-service tax compliance service provider. In 2000, the company developed its own cloud-based technology. The first version of attendance was released in 2001. In 2004, APS Payroll submitted The first payroll was submitted online and the first version of its core HR solution was released. APS Payroll expanded its HR solution to include benefits administration in 2007. The Attendance solution was expanded to include shift differentials and clock rules in 2010. APS Payroll released its mobile self-service site for employees and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privately Held Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SOC 1

System and Organization Controls (SOC), (also sometimes referred to as service organizations controls) as defined by the American Institute of Certified Public Accountants (AICPA), is the name of a suite of reports produced during an audit. It is intended for use by service organizations (organizations that provide information systems as a service to other organizations) to issue validated reports of internal controls Internal control, as defined by accounting and auditing, is a process for assuring of an organization's objectives in operational effectiveness and efficiency, reliable financial reporting, and compliance with laws, regulations and policies. A broad ... over those information systems to the users of those services. The reports focus on controls grouped into five categories called ''Trust Service Principles''. The AICPA auditing standard Statement on Standards for Attestation Engagements no. 18 (SSAE 18), section 320, "Reporting on an Examination of Controls at a Se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll

A payroll is the list of employees of some company that is entitled to receive payments as well as other work benefits and the amounts that each should receive. Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including salaries and wages, bonuses, and withheld taxes, or the company's department that deals with compensation. A company may handle all aspects of the payroll process in-house or can outsource aspects to a payroll processing company. Payroll in the U.S. is subject to federal, state and local regulations including employee exemptions, record keeping, and tax requirements. Frequency Companies typically process payroll at regular intervals. This interval varies from company to company and may differ within the company for different types of employee. According to research conducted in February 2022 by the U.S. Department of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 1996

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assessme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Services Companies Established In 1996

Business is the practice of making one's living or making money by producing or buying and selling products (such as goods and services). It is also "any activity or enterprise entered into for profit." Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business. If the business acquires debts, the creditors can go after the owner's personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company, such as a corporation or cooperative. Corporations, in contrast with sole proprietors and partnerships, are a separate legal entity and provide limited liability for their owners/members, as well as being subject to corporate tax rates. A corporation is more complicated and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Based In Shreveport, Louisiana

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is generating profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared incorporation, or published policy. When a company closes, it may need to be liquidated to avoid further legal obligations. Companies may associate and collectively register themselves as new companies; the resulting entities are often known as corporate groups. Meanings and definitions A company can be defined as an "artificial per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Services Companies Of The United States

Business is the practice of making one's living or making money by producing or buying and selling products (such as goods and services). It is also "any activity or enterprise entered into for profit." Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business. If the business acquires debts, the creditors can go after the owner's personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company, such as a corporation or cooperative. Corporations, in contrast with sole proprietors and partnerships, are a separate legal entity and provide limited liability for their owners/members, as well as being subject to corporate tax rates. A corporation is more complicated and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1996 Establishments In Louisiana

File:1996 Events Collage.png, From left, clockwise: A bomb explodes at Centennial Olympic Park in Atlanta, set off by a radical anti-abortionist; The center fuel tank explodes on TWA Flight 800, causing the plane to crash and killing everyone on board; Eight people die in a blizzard on Mount Everest; Dolly the Sheep becomes the first mammal to have been cloned from an adult somatic cell; The Port Arthur Massacre occurs on Tasmania, and leads to major changes in Australia's gun laws; Macarena, sung by Los del Río and remixed by The Bayside Boys, becomes a major dance craze and cultural phenomenon; Ethiopian Airlines Flight 961 crash-ditches off of the Comoros Islands after the plane was hijacked; the 1996 Summer Olympics are held in Atlanta, marking the Centennial (100th Anniversary) of the modern Olympic Games., 300x300px, thumb rect 0 0 200 200 Centennial Olympic Park bombing rect 200 0 400 200 TWA FLight 800 rect 400 0 600 200 1996 Mount Everest disaster rect 0 200 300 400 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CARES Act

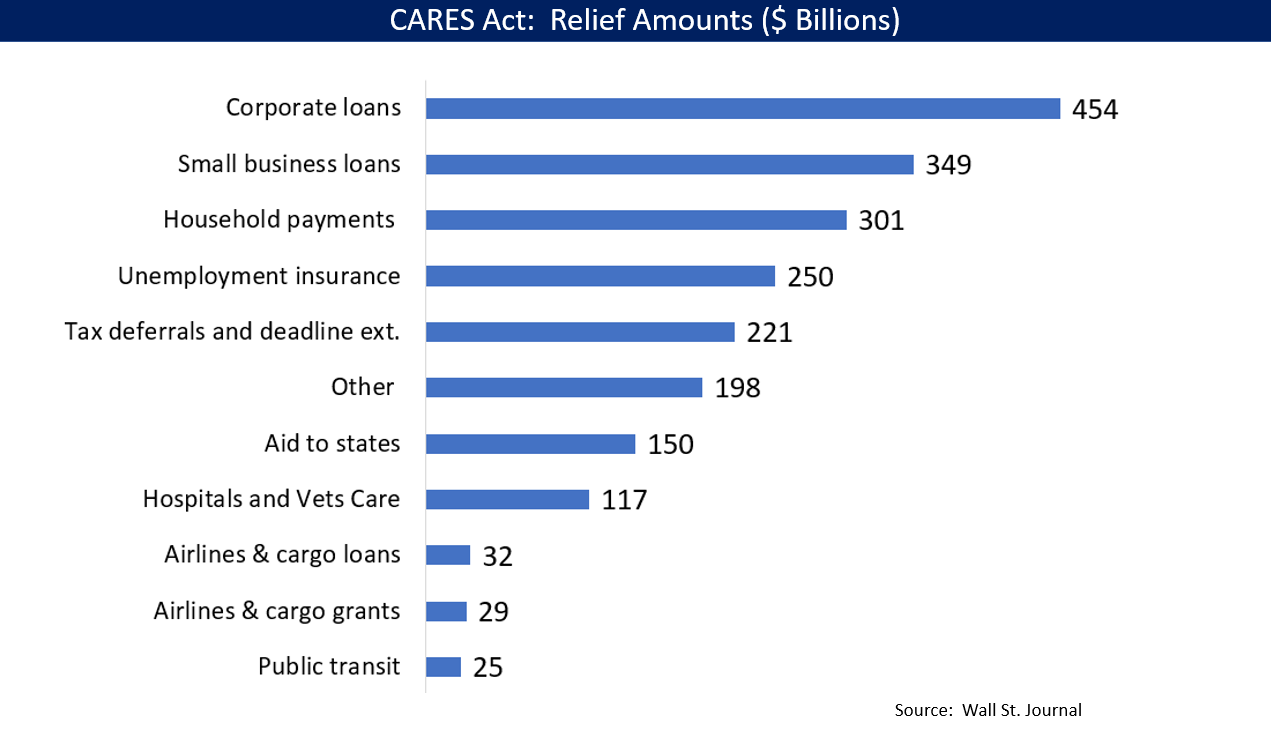

The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is a $2.2trillion Stimulus (economics), economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout of the COVID-19 pandemic in the United States. The spending primarily includes $300billion in one-time cash payments to individual people who submit a tax return in America (with most single adults receiving $1,200 and families with children receiving more), $260billion in increased unemployment benefits, the creation of the Paycheck Protection Program that provides forgivable loans to small businesses with an initial $350billion in funding (later increased to $669billion by subsequent legislation), $500billion in loans for corporations, and $339.8 billion to state and local governments. The original CARES Act proposal included $500billion in direct payments to Americans, $208billion in loans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FFCRA

The Families First Coronavirus Response Act is an Act of Congress () meant to respond to the economic impacts of the ongoing COVID-19 pandemic. The act provides funding for free coronavirus testing, 14-day paid leave for American workers affected by the pandemic, and increased funding for food stamps. The bill was sponsored by House Appropriations Committee Chairwoman Nita M. Lowey (D–NY) and passed the United States House of Representatives early on March 14, 2020, before moving on to the United States Senate. President Donald Trump had voiced support for the legislative agreement. The Senate passed the legislation on March 18, 2020. Trump signed the bill into law later that day. Contents In a statement, the White House said the law "provides paid leave, establishes free coronavirus testing, supports strong unemployment benefits, expands food assistance for vulnerable children and families, protects front-line health workers, and provides additional funding to states for the o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sage Intacct

Sage Intacct, Inc is an American provider of cloud-based Financial management and services available in five regions around the globe -- including the United States, Canada, the UK, Australia, and South Africa. Its products offer cloud-based accounting applications that enable business payments, manage and pay bills, and facilitate payroll functions. The company was founded in 1999 and it was acquired by The Sage Group PLC for $850 million in 2017. History Intacct was founded by Odysseas Tsatalos and David Chandler Thomas in 1999 as one of the first accounting applications for the cloud. The company was headquartered in San Jose, California, grew organically and offered a suite of accounting software that could serve medium and large-sized businesses with consolidated ERP, and e-commerce features. In 2000, Intacct got its first institutional investor, venture capital firm HWVP and completed a Series A round of $10 million. From 2001 to 2014, the company raised $130 million ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |