|

Above The Line (other)

Above the line may refer to: *Above the line (filmmaking), an accounting term used in film production to denote expenditures that occur prior to filming *Above-the-line deduction, a type of tax deduction in the United States of America * Above the line (advertising), advertising involving mass media *A component of contract bridge scoring *The group voting ticket option in Australian elections *Above the Line, the colloquial name for the Research and Development Expenditure Credit The Research and Development Expenditure Credit (RDEC), introduced in 2013, is a UK tax incentive designed to encourage large companies to invest in R&D in the UK. Companies can reduce their tax bill or claim payable cash credits as a proportion ... technology tax relief scheme in the UK See also * Below the line (other) {{disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Above The Line (filmmaking)

"Above-the-line" refers to the list of individuals who guide and influence the creative direction, process, and voice of a given narrative in a film and related expenditures. These roles include but are not limited to the screenwriter, producer, director, and actors. Often, the term is used for matters related to the film's production budget. Above-the-line expenditures reflect the expected line item compensation for an official above-the-line member's role in a given film project. These expenditures are usually set, negotiated, spent and/or promised before principal photography begins. They include rights to secure the material on which the screenplay is based, production rights to the screenplay, compensation for the screenwriter, producer, director, principal actors and other cost-related line items such as assistants for the producers, director or actors. The distinction originates from the early studio days when the budget top-sheet would literally have a line separating t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Above-the-line Deduction

In the United States tax law, an above-the-line deduction is a deduction that the Internal Revenue Service allows a taxpayer to subtract from his or her gross income in arriving at "adjusted gross income" for the taxable year. These deductions are set forth in Internal Revenue Code Section 62. A taxpayer's gross income minus his or her above-the-line deductions is equal to the adjusted gross income. Because these deductions are taken before adjusted gross income is calculated, they are designated "above-the-line". Thus, those deductions allowed in computing "taxable income" under section 63 of the IRC are "below-the-line deductions" (thus, adjusted gross income represents "the line"). Above-the-line deductions may be more valuable to high-income taxpayers than below-the-line deductions. Since tax year 2018, above-the-line deductions are reported on Schedule 1 of IRS Form 1040. Impact Above-the-line deductions are generally more advantageous for a high income taxpayer than so-call ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Above The Line (advertising)

Advertising is the practice and techniques employed to bring attention to a product or service. Advertising aims to put a product or service in the spotlight in hopes of drawing it attention from consumers. It is typically used to promote a specific good or service, but there are wide range of uses, the most common being the commercial advertisement. Commercial advertisements often seek to generate increased consumption of their products or services through "branding", which associates a product name or image with certain qualities in the minds of consumers. On the other hand, ads that intend to elicit an immediate sale are known as direct-response advertising. Non-commercial entities that advertise more than consumer products or services include political parties, interest groups, religious organizations and governmental agencies. Non-profit organizations may use free modes of persuasion, such as a public service announcement. Advertising may also help to reassure employees ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

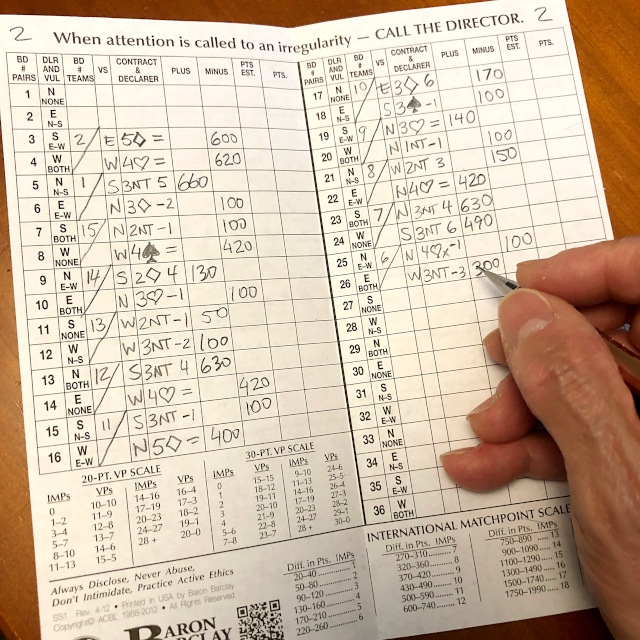

Bridge Scoring

While a deal of bridge is always played following a unique set of rules, its scoring may vary depending on the type of event the deal is played on. There are two main categories of scoring: rubber and duplicate. Rubber scoring, and its popular variant Chicago, are mostly used in social play. Duplicate scoring is focused on tournament competition and has many variations that compare and rank the relative performance of partnerships and teams playing the same deals as their competitors. Terminology The following terms and concepts, defined in the glossary of contract bridge terms, are essential to understanding bridge scoring: * * * * * or Made * * * and grand slam * *Undoubled, and *, and Scoring elements Bridge scoring consists of nine elements. Not all elements are included in all game variants and the method of accumulation of the elements over several deals varies. * If the contract is made, the score for each such deal consists of: ** Contract points, assigned to ea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Group Voting Ticket

A group voting ticket (GVT) is a shortcut for voters in a preferential voting system, where a voter can indicate support for a list of candidates instead of marking preferences for individual candidates. For multi-member electoral divisions with single transferable voting, a group or party registers a GVT before an election with the electoral commission. When a voter selects a group or party "above the line" on a ballot paper, their vote is distributed according to the registered GVT for that group. In Australia it is known as group ticket vote or ticket voting. As of 2022, group voting tickets are used for elections in only one jurisdiction in the country: the Victorian Legislative Council, the upper house of the legislature in the Australian state of Victoria. In South Australia House of Assembly elections, parties can submit preference tickets which are used to save a vote that would otherwise be informal. GVTs have been abolished by New South Wales, South Australia and Western A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Research And Development Expenditure Credit

The Research and Development Expenditure Credit (RDEC), introduced in 2013, is a UK tax incentive designed to encourage large companies to invest in R&D in the UK. Companies can reduce their tax bill or claim payable cash credits as a proportion of their R&D expenditure. The initiative builds on the existing R&D Tax Credit scheme which has been in operation for large companies since 2002 and is one of a number of technology tax relief schemes introduced by successive UK Governments. Originally referred to as to as "Above the Line R&D Tax Relief", because the payable credit for large companies is now shown above the tax line and can effectively be accounted for as income in the profit and loss statement, RDEC is now the common terminology used for the scheme. History R&D tax relief is designed to incentivise investment in R&D. The scheme was introduced in 2000 for small and medium enterprises, with a separate scheme for large companies launched in 2002. Any company carrying ou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |