|

401k Plans

In the United States, a 401(k) plan is an employer-sponsored, defined contribution, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodical employee contributions come directly out of their paychecks, and may be Employer matching program, matched by the employer. This legal option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. There are two types: traditional and Roth 401(k). For Roth accounts, contributions and withdrawals have no impact on income tax. For traditional accounts, contributions may be deducted from taxable income and withdrawals are added to taxable income. There are limits to contributions, rules governing withdrawals and possible penalties. The benefit of the Roth account is from tax-free capital gains. The net benefit of the traditional account is the sum of (1) a possible bonus (or penalty) from withdrawals at ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defined Contribution

A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts (through employee contributions and, if applicable, employer contributions) plus any investment earnings on the money in the account. In defined contribution plans, future benefits fluctuate on the basis of investment earnings. The most common type of defined contribution plan is a savings and thrift plan. Under this type of plan, the employee contributes a predetermined portion of his or her earnings (usually pretax) to an individual account, all or part of which is matched by the employer. In the United States, specifies a defined contribution plan as a "plan which provides for an individual account for each participant and for benefits based solely on the amount contributed to the participant's account, and any income, expense ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Substantially Equal Periodic Payments

Substantially equal periodic payments (SEPP) are one of the exceptions in the United States Internal Revenue Code that allows a retiree to receive payments before age 59 from a retirement plan or deferred annuity In investment, an annuity is a series of payments made at equal intervals.Kellison, Stephen G. (1970). ''The Theory of Interest''. Homewood, Illinois: Richard D. Irwin, Inc. p. 45 Examples of annuities are regular deposits to a savings account, ... without the 10% early distribution penalty under certain circumstances. Rules The rules for SEPPs are set out in Code section 72(t) (for retirement plans) and section 72(q) (for annuities), and allow for three methods of calculating the allowed withdrawal amount: *Required minimum distribution method, based on the life expectancy of the account owner (or the joint life of the owner and his/her beneficiary) using the IRS tables for required minimum distributions. *Fixed amortization method over the life expectancy of the o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension Protection Act Of 2006

The Pension Protection Act of 2006 (), 120 Stat. 780, was signed into law by U.S. President George W. Bush on August 17, 2006. Pension reform This legislation requires companies who have underfunded their pension plans to pay higher premiums to the Pension Benefit Guaranty Corporation (PBGC) and extends the requirement of providing extra funding to the pension systems of companies that terminate their pension plans. It also requires companies to analyze their pension plans' obligations more accurately, closes loopholes that previously allowed some companies to underfund their plans by skipping payments, and raises the cap on the amount employers are allowed to invest in their own plans. This will allow employers to deduct more money using the pension tax shield in times of high profits. It requires actuaries to use the equivalent of the projected accrued benefit cost method for determining annual normal cost. Other elements: * Provides statutory authority for employers to enroll ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Safe Harbor (law)

A safe harbor is a provision of a statute or a regulation that specifies that certain conduct will be deemed not to violate a given rule. It is usually found in connection with a more-vague, overall standard. By contrast, "''un''safe harbors" describe conduct that ''will'' be deemed to violate the rule. For example, in the context of a statute that requires drivers to "not drive recklessly," a clause specifying that "driving under 25 miles per hour will be conclusively deemed not to constitute reckless driving" is a "safe harbor." Likewise, a clause saying that "driving over 90 miles per hour will be conclusively deemed to constitute reckless driving" would be an "unsafe harbor." In this example, driving between 25 miles per hour and 90 miles per hour would fall outside of either a safe harbor or an unsafe harbor, and would thus be left to be judged according to the vague "reckless" standard. Theoretical justifications Safe harbors have been promoted by legal writers as redu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employer Matching Contribution

In the United States, an employer matching program is an employer's potential payment to their 401(k) plan that depends on participating employees' contribution to the plan. Background An employee's 401(k) plan is a retirement savings plan. The option of an employer matching program varies from company to company. It is not mandatory for a company to offer a contribution to their 401(k) plans. Contributions may benefit the company in various ways: as an employee benefit to attract and retain employees, as a business tax deduction, or as a safe harbor contribution to automatically pass certain annual testing of the plan required by the IRS and Department of Labor or to fulfill the plan's top-heavy provisions. Many companies add to an employee's charity contribution. Through a corporate matching gift program, a company can double or even triple an employee's contribution toward a charity. This should not be confused with an employer matching program. "100% of the first 6%" As o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, ''Individual Retirement Arrangements (IRAs)''. Other arrangements include employer-established benefit trusts and individual retirement annuities, by which a taxpayer purchases an annuity contract or an endowment contract from a life insurance company. Types There are several types of IRAs: * Traditional IRA – Contributions are often tax-deductible (often simplified as "money is deposited before tax" or "contributions are made with pre-tax assets"), all transactions and earnings within the IRA have no tax impact, and withdrawals at retirement are taxed as income (e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IRA Required Minimum Distributions

Required minimum distributions (RMDs) are amounts that U.S. tax law requires one to withdraw annually from traditional IRAs and employer-sponsored retirement plans. In the Internal Revenue Code itself, the precise term is "minimum required distribution". Retirement planners, tax practitioners, and publications of the Internal Revenue Service (IRS) often use the phrase "required minimum distribution". Lifetime distributions Individuals with IRAs are required to begin lifetime RMDs from their IRAs no later than April 1 of the year following the year in which they reach age 72. IRA owners do not have to take lifetime distributions from Roth IRAs, but after-death distributions (below) are required. They can always withdraw more than the minimum amount from their IRA or plan in any year, but if they withdraw less than the required minimum, they will be subject to a federal penalty. The monetary penalty is an excise tax equal to 50% of the amount they should have withdrawn, plus interest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washington, D.C. Senators and representatives are chosen through direct election, though vacancies in the Senate may be filled by a governor's appointment. Congress has 535 voting members: 100 senators and 435 representatives. The U.S. vice president has a vote in the Senate only when senators are evenly divided. The House of Representatives has six non-voting members. The sitting of a Congress is for a two-year term, at present, beginning every other January. Elections are held every even-numbered year on Election Day. The members of the House of Representatives are elected for the two-year term of a Congress. The Reapportionment Act of 1929 establishes that there be 435 representatives and the Uniform Congressional Redistricting Act requires ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Recession In The United States

The Great Recession in the United States was a severe financial crisis combined with a deep recession. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment and output Output may refer to: * The information produced by a computer, see Input/output * An output state of a system, see state (computer science) * Output (economics), the amount of goods and services produced ** Gross output in economics, the value of .... This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis along with restrained government spending following initial stimulus efforts. It followed the bursting of the United States housing bubble, housing bubble, the United States housing market correction, housing market correction and subprime mortgage crisis. According to the United States Department of Labor, Department of Labor, rou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit or reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs. For example, a customer would usually pay interest to borrow from a bank, so they pay the bank an amount which is more than the amount they borrowed; or a customer may earn interest on their savings, and so they may withdraw more than they originally deposited. In the case of savings, the customer is the lender, and the bank plays the role of the borrower. Interest diff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CARES Act

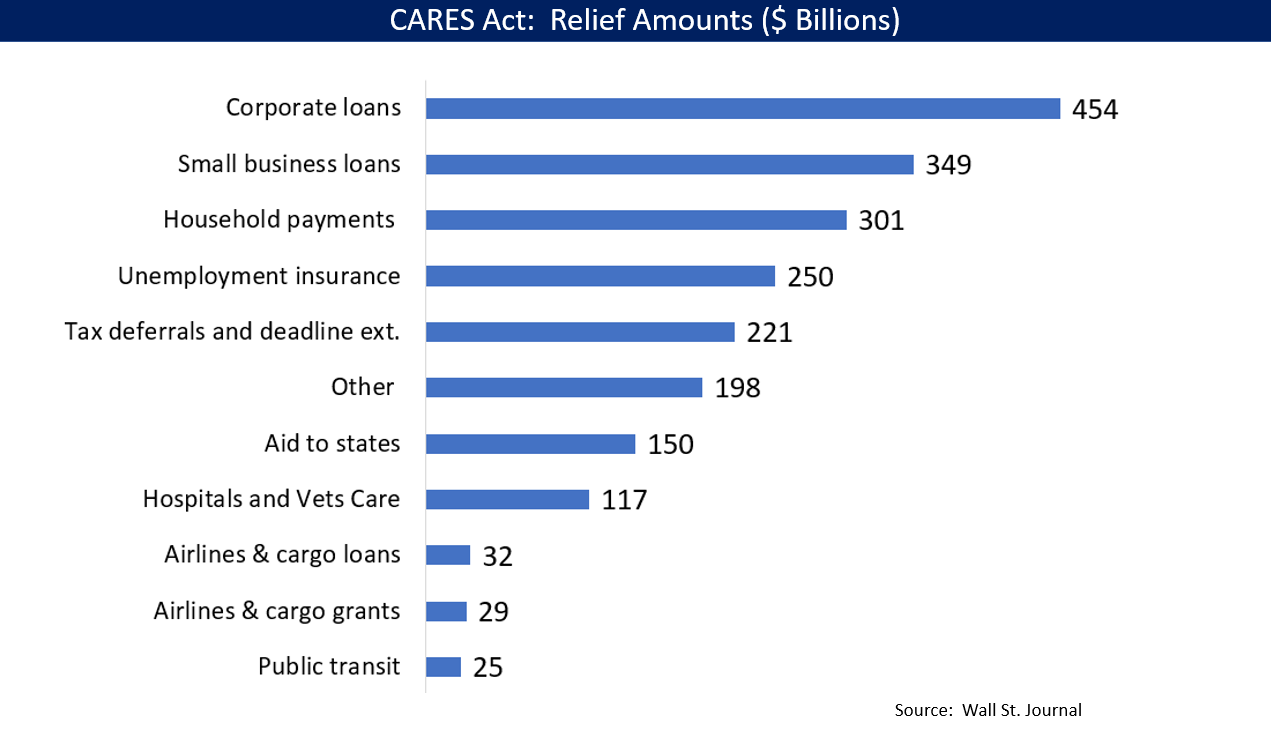

The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is a $2.2trillion Stimulus (economics), economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout of the COVID-19 pandemic in the United States. The spending primarily includes $300billion in one-time cash payments to individual people who submit a tax return in America (with most single adults receiving $1,200 and families with children receiving more), $260billion in increased unemployment benefits, the creation of the Paycheck Protection Program that provides forgivable loans to small businesses with an initial $350billion in funding (later increased to $669billion by subsequent legislation), $500billion in loans for corporations, and $339.8 billion to state and local governments. The original CARES Act proposal included $500billion in direct payments to Americans, $208billion in loans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |