|

2009 United States Federal Budget

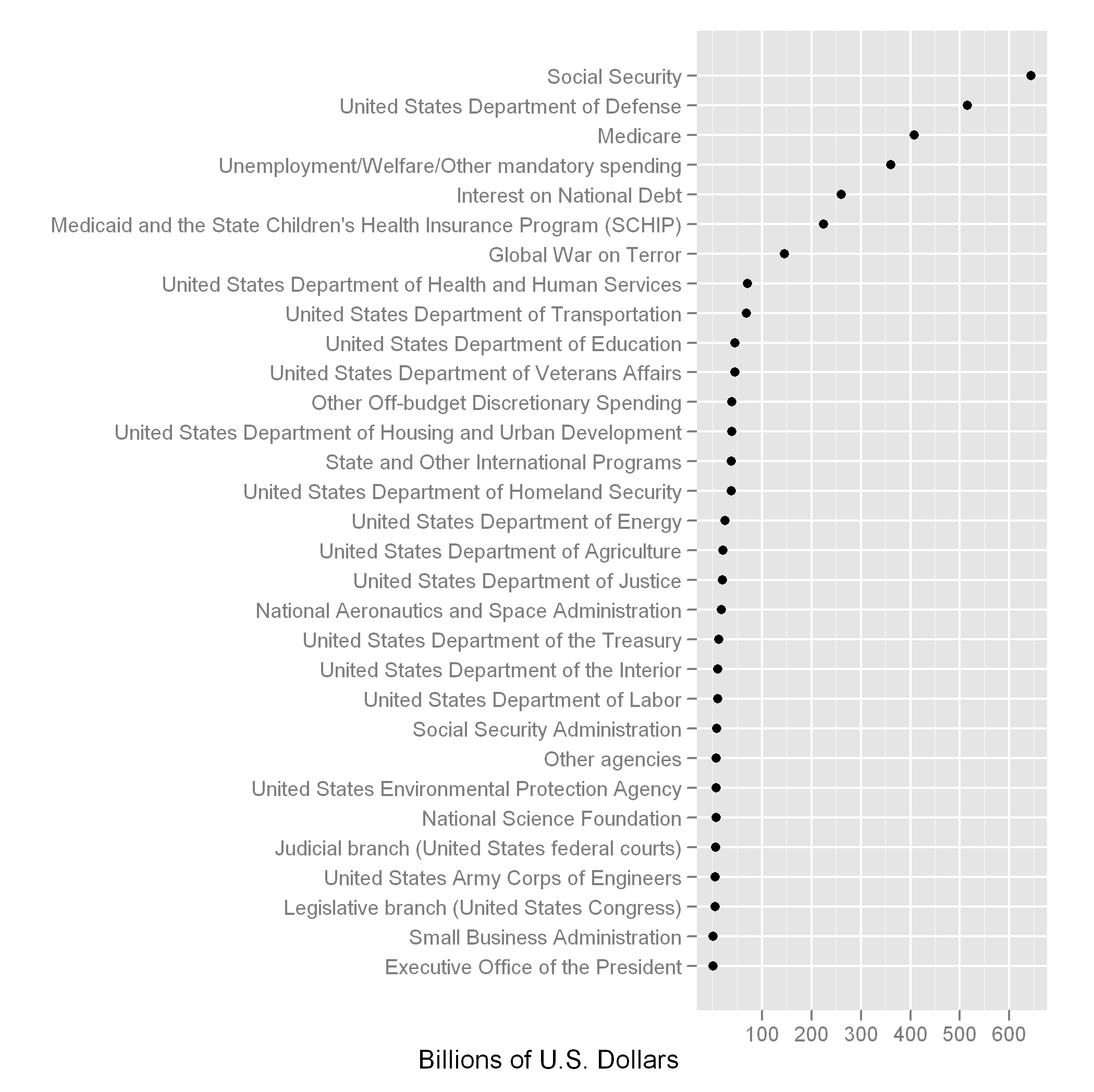

The United States federal budget for fiscal year 2009 began as a spending request submitted by President George W. Bush to the 110th Congress. The final resolution written and submitted by the 110th Congress to be forwarded to the President was approved by the House on June 5, 2008. The government was initially funded through three temporary continuing resolutions. Final funding for the Department of Defense, Department of Homeland Security, and Department of Veterans Affairs was enacted on September 30, 2008 as part of the Consolidated Security, Disaster Assistance, and Continuing Appropriations Act, 2009, while the remaining departments and agencies were funded as part of an omnibus spending bill, the Omnibus Appropriations Act, 2009, on March 10, 2009. Total receipts ''(in billions of dollars)'' Total spending The 110th Congress' budget for 2009 totaled $3.1 trillion. Percentages in parentheses indicate percentage change compared to 2008. This budget request is broken ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NARA

The National Archives and Records Administration (NARA) is an " independent federal agency of the United States government within the executive branch", charged with the preservation and documentation of government and historical records. It is also tasked with increasing public access to those documents which make up the National Archive. NARA is officially responsible for maintaining and publishing the legally authentic and authoritative copies of acts of Congress, presidential directives, and federal regulations. NARA also transmits votes of the Electoral College to Congress. It also examines Electoral College and Constitutional amendment ratification documents for prima facie legal sufficiency and an authenticating signature. The National Archives, and its publicly exhibited Charters of Freedom, which include the original United States Declaration of Independence, United States Constitution, United States Bill of Rights, and many other historical documents, is headquart ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll Tax

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital such as higher education. National payroll tax systems Australia The Australian federal government (ATO) requires withholding tax on employment income (payroll taxes of the first type), under a system known as pay-as-you-go (PAYG). The individual states impose payroll taxes of the second type. Bermuda In Bermuda, payroll tax accounts for over a third of the annual national bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Department Of Health And Human Services

The United States Department of Health and Human Services (HHS) is a cabinet-level executive branch department of the U.S. federal government created to protect the health of all Americans and providing essential human services. Its motto is "Improving the health, safety, and well-being of America". Before the separate federal Department of Education was created in 1979, it was called the Department of Health, Education, and Welfare (HEW). HHS is administered by the Secretary of Health and Human Services, who is appointed by the president with the advice and consent of the United States Senate. The position is currently held by Xavier Becerra. The United States Public Health Service Commissioned Corps, the uniformed service of the PHS, is led by the Surgeon General who is responsible for addressing matters concerning public health as authorized by the secretary or by the assistant secretary for Health in addition to his or her primary mission of administering the Commission ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

War On Terrorism

The war on terror, officially the Global War on Terrorism (GWOT), is an ongoing international counterterrorism military campaign initiated by the United States following the September 11 attacks. The main targets of the campaign are militant Islamist and Salafi-Jihadist armed organisations such as Al-Qaeda, the Islamic State and their international affiliates; which are waging military insurgencies to overthrow governments of various Muslim countries. The "war on terror" uses war as a metaphor to describe a variety of actions which fall outside the traditional definition of war taken to eliminate international terrorism. 43rd President of the United States George W. Bush first used the term "war on terrorism" on 16 September 2001, and then "war on terror" a few days later in a formal speech to Congress. Bush indicated the enemy of the war on terror as "a radical network of terrorists and every government that supports them." The initial conflict was aimed at al-Qaeda, with th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Children's Health Insurance Program

The Children's Health Insurance Program (CHIP) – formerly known as the State Children's Health Insurance Program (SCHIP) – is a program administered by the United States Department of Health and Human Services that provides matching funds to states for health insurance to families with children. The program was designed to cover uninsured children in families with incomes that are modest but too high to qualify for Medicaid. The program was passed into law as part of the Balanced Budget Act of 1997, and the statutory authority for CHIP is under title XXI of the Social Security Act. CHIP was formulated in the aftermath of the failure of President Bill Clinton's comprehensive health care reform proposal. Legislation to create CHIP was co-sponsored by Democratic Senator Ted Kennedy and Republican Senator Orrin Hatch, and received strong support from First Lady Hillary Clinton. Despite opposition from some conservatives, SCHIP was included in the Balanced Budget Act of 1997, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Medicaid

Medicaid in the United States is a federal and state program that helps with healthcare costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The main difference between the two programs is that Medicaid covers healthcare costs for people with low incomes while Medicare provides health coverage for the elderly. There are also dual health plans for people who have both Medicaid and Medicare. The Health Insurance Association of America describes Medicaid as "a government insurance program for persons of all ages whose income and resources are insufficient to pay for health care." Medicaid is the largest source of funding for medical and health-related services for people with low income in the United States, providing free health insurance to 74 million low-income and disabled people (23% of Americans) as of 2017, as well as paying for half of all U.S. births i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Medicare (United States)

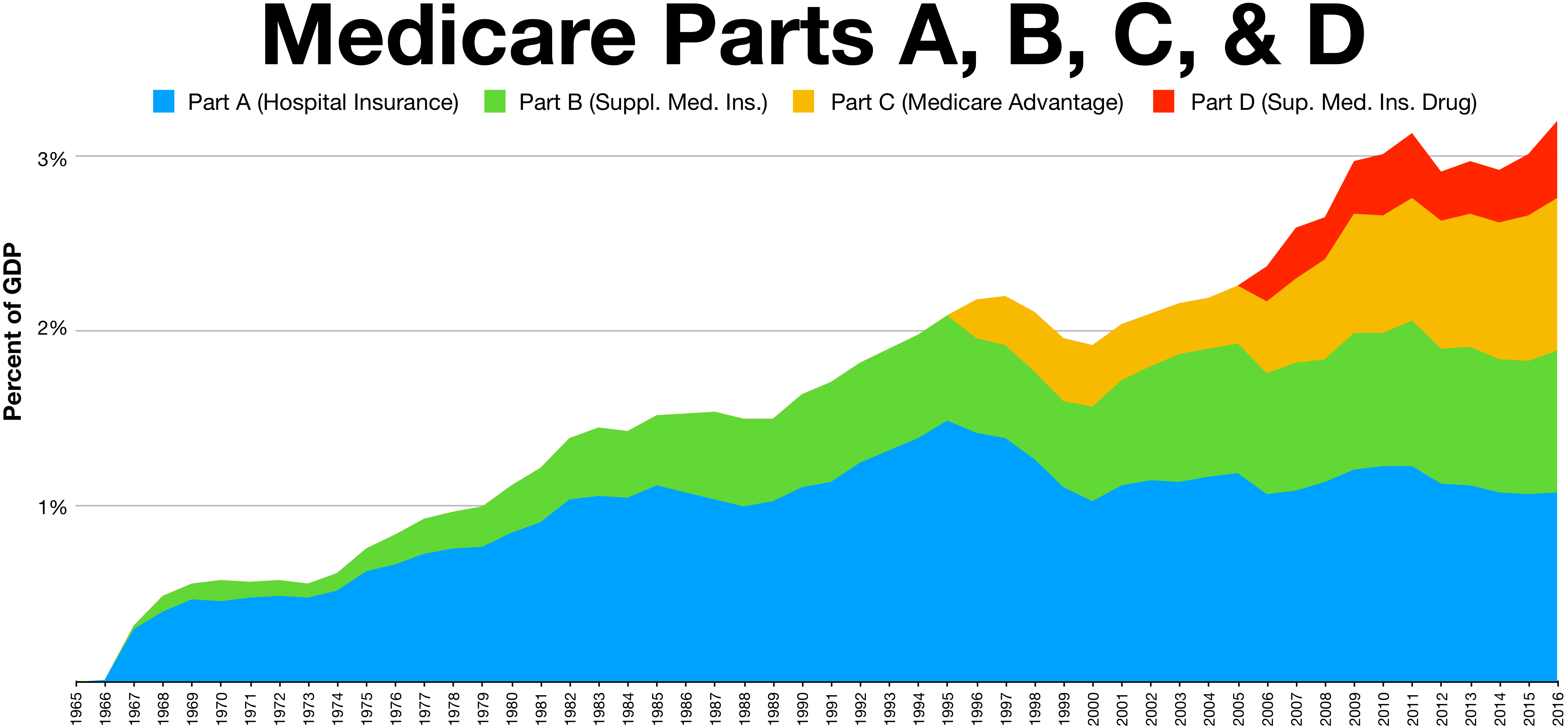

Medicare is a government national health insurance program in the United States, begun in 1965 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, but also for some younger people with disability status as determined by the SSA, including people with end stage renal disease and amyotrophic lateral sclerosis (ALS or Lou Gehrig's disease). In 2018, according to the 2019 Medicare Trustees Report, Medicare provided health insurance for over 59.9 million individuals—more than 52 million people aged 65 and older and about 8 million younger people. According to annual Medicare Trustees reports and research by the government's MedPAC group, Medicare covers about half of healthcare expenses of those enrolled. Enrollees almost always cover most of the remaining costs by taking additional private insurance and/or by joining a public Part C or P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US2009FederalExpenditures

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Ameri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duty (economics)

In economics, a duty is a target-specific form of tax levied by a state or other political entity. It is often associated with customs, in which context they are also known as tariffs or dues. The term is often used to describe a tax on certain items purchased abroad. A duty is levied on specific commodities, financial transactions, estates, etc. rather than being a direct imposition on individuals or corporations such income or property taxes. Examples include customs duty, excise duty, stamp duty, estate duty, and gift duty. Customs duty A customs duty or due is the indirect tax levied on the import or export of goods in international trade. In economics a duty is also a kind of consumption tax. A duty levied on goods being imported is referred to as an 'import duty', and one levied on exports an 'export duty'. Estate duty An estate duty (in the U.S. inheritance tax) is a tax levied on the estate of a deceased person in many jurisdictions or on the inheritance of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Customs

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties (i.e. tariffs) and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, security, and trade facilitation. Each country has its own laws and regulations for the import and export of goods into and out of a country, enforced by their respective customs authorities; the import/export of some goods may be restricted or forbidden entirely. A wide range of penalties are faced by those who break these laws. Overview Taxation The traditional function of customs has been the assessment and collection of customs duties, which is a tariff or tax on the importation o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift Tax

In economics, a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. The transfer must be gratuitous or the receiving party must pay a lesser amount than the item's full value to be considered a gift. Items received upon the death of another are considered separately under the inheritance tax. Many gifts are not subject to taxation because of exemptions given in tax laws. The gift tax amount varies by jurisdiction, and international comparison of rates is complex and fluid. The process of transferring assets and wealth to the upcoming generations is known as estate planning. It involves planning for transfers at death or during life. One such instrument is the right to transfer assets to another person known as gift-giving, or with the goal of reducing one's taxable wealth when the donor still lives. For fulfilling the crit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. International tax law distinguishes between an estate tax and an inheritance tax—an estate tax is assessed on the assets of the deceased, while an inheritance tax is assessed on the legacies received by the estate's beneficiaries. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. For historical reasons, the term death duty is still used colloquially (though not legally) in the UK and some Commonwealth countries. For political, statutory and other reasons, the term death tax is sometimes used to refer to estate tax in the United States. Varieties of inheritance and estate taxes * Belgium, droits de succession or erfbelasting (Inheritance tax). Collected at t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |