|

Protectionist

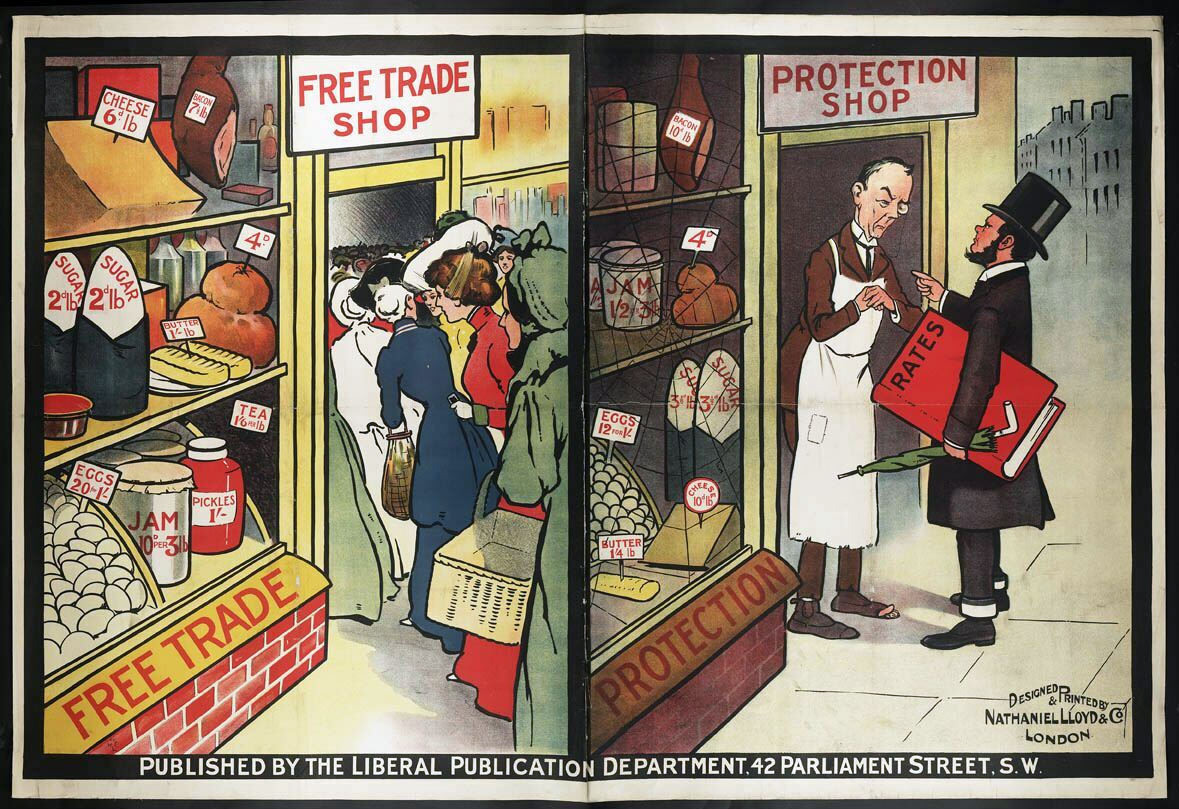

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. Proponents argue that protectionist policies shield the producers, businesses, and workers of the import-competing sector in the country from foreign competitors. Opponents argue that protectionist policies reduce trade and adversely affect consumers in general (by raising the cost of imported goods) as well as the producers and workers in export sectors, both in the country implementing protectionist policies and in the countries protected against. Protectionism is advocated mainly by parties that hold economic nationalist or left-wing positions, while economically right-wing political parties generally support free trade. There is a consensus among economists that protectionism has a negative effect on economic growth and economic we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Liberalization

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold economically liberal positions, while economic nationalist and left-wing political parties generally support protectionism, the opposite of free trade. Most nations are today members of the World Trade Organization multilateral trade agreements. Free trade was best exemplified by the unilateral stance of Great Britain who reduced regulations and duties on imports and exports from the mid-nineteenth century to the 1920s. An alternative approach, of creating free trade areas between groups of countries by agreement, such as that of the European Economic Area and the Mercosur open markets, creates a protectionist barrier between that free trade area and the rest of the world. Most governments still impose some protectionist policies that are in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Trade

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold economically liberal positions, while economic nationalist and left-wing political parties generally support protectionism, the opposite of free trade. Most nations are today members of the World Trade Organization multilateral trade agreements. Free trade was best exemplified by the unilateral stance of Great Britain who reduced regulations and duties on imports and exports from the mid-nineteenth century to the 1920s. An alternative approach, of creating free trade areas between groups of countries by agreement, such as that of the European Economic Area and the Mercosur open markets, creates a protectionist barrier between that free trade area and the rest of the world. Most governments still impose some protectionist policies that are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The Financial contagion, economic contagion began around September and led to the Wall Street Crash of 1929, Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide Gross domestic product, gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Nationalism

Economic nationalism, also called economic patriotism and economic populism, is an ideology that favors state interventionism over other market mechanisms, with policies such as domestic control of the economy, labor, and capital formation, including if this requires the imposition of tariffs and other restrictions on the movement of labor, goods and capital. The core belief of economic nationalism is that the economy should serve nationalist goals. Economic nationalists oppose globalization or at least question the benefits of unrestricted free trade. They favor protectionism and advocate for self-sufficiency. To economic nationalists, markets are to be subordinate to the state, and should serve the interests of the state (such as providing national security and accumulating military power). The doctrine of mercantilism is a prominent variant of economic nationalism. Economic nationalists tend to see international trade as zero-sum, where the goal is to derive relative gains (as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Import Substitution Industrialization

Import substitution industrialization (ISI) is a trade and economic policy that advocates replacing foreign imports with domestic production.''A Comprehensive Dictionary of Economics'' p.88, ed. Nelson Brian 2009. It is based on the premise that a country should attempt to reduce its foreign dependency through the local production of industrialized products. The term primarily refers to 20th-century development economics policies, but it has been advocated since the 18th century by economists such as Friedrich ListMehmet, Ozay (1999). ''Westernizing the Third World: The Eurocentricity of Economic Development.'' London: Routledge. and Alexander Hamilton.Chang, Ha-Joon (2002). ''Kicking Away the Ladder: Development Strategy in Historical Perspective.'' London: Anthem Press. ISI policies have been enacted by developing countries with the intention of producing development and self-sufficiency by the creation of an internal market. The state leads economic development by national ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidy

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the term subsidy can relate to any type of support – for example from NGOs or as implicit subsidies. Subsidies come in various forms including: direct (cash grants, interest-free loans) and indirect ( tax breaks, insurance, low-interest loans, accelerated depreciation, rent rebates). Furthermore, they can be broad or narrow, legal or illegal, ethical or unethical. The most common forms of subsidies are those to the producer or the consumer. Producer/production subsidies ensure producers are better off by either supplying market price support, direct support, or payments to factors of production. Consumer/consumption subsidies commonly reduce the price of goods and services to the consumer. For example, in the US at one time it was cheaper to b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Douglas Irwin

Douglas A. Irwin is the John Sloan Dickey Third Century Professor in the Social Sciences in the Economics Department at Dartmouth College and the author of seven books. He is an expert on both past and present U.S. trade policy, especially policy during the Great Depression. He is frequently sought by media outlets such as The Economist and Wall Street Journal to provide comment and his opinion on current events. He also writes op-eds and articles about trade for mainstream media outlets like ''The Wall Street Journal'', ''The New York Times'', and ''Financial Times''. He is also a nonresident senior fellow at the Peterson Institute for International Economics. Prior to his appointment to as professor at Dartmouth, Irwin was an associate professor of business economics at the University of Chicago Booth School of Business, an economist for the Board of Governors of the Federal Reserve System, and an economist for the Council of Economic Advisers Executive Office of the president. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid digital media, digital subscribers. It also is a producer of popular podcasts such as ''The Daily (podcast), The Daily''. Founded in 1851 by Henry Jarvis Raymond and George Jones (publisher), George Jones, it was initially published by Raymond, Jones & Company. The ''Times'' has won List of Pulitzer Prizes awarded to The New York Times, 132 Pulitzer Prizes, the most of any newspaper, and has long been regarded as a national "newspaper of record". For print it is ranked List of newspapers by circulation, 18th in the world by circulation and List of newspapers in the United States, 3rd in the U.S. The paper is owned by the New York Times Company, which is Public company, publicly traded. It has been governed by the Sulzberger family since 189 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Food Safety

Food safety (or food hygiene) is used as a scientific method/discipline describing handling, preparation, and storage of food in ways that prevent food-borne illness. The occurrence of two or more cases of a similar illness resulting from the ingestion of a common food is known as a food-borne disease outbreak. This includes a number of routines that should be followed to avoid potential health hazards. In this way, food safety often overlaps with food defense to prevent harm to consumers. The tracks within this line of thought are safety between industry and the market and then between the market and the consumer. In considering industry to market practices, food safety considerations include the origins of food including the practices relating to food labeling, food hygiene, food additives and pesticide residues, as well as policies on biotechnology and food and guidelines for the management of governmental import and export inspection and certification systems for fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically imp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)

.png)

.jpg)