|

Trust (business)

A trust or corporate trust is a large grouping of business interests with significant market power, which may be embodied as a corporation or as a group of corporations that cooperate with one another in various ways. These ways can include constituting a trade association, owning stock in one another, constituting a corporate group (sometimes specifically a conglomerate (company), conglomerate), or combinations thereof. The term ''trust'' is often used in a historical sense to refer to monopoly, monopolies or near-monopolies in the United States during the Second Industrial Revolution in the 19th century and early 20th century. The use of corporate trusts during this period is the historical reason for the name "United States antitrust law, antitrust law". In the broader sense of the term, relating to trust law, a trust is a centuries-old legal arrangement whereby one party conveys legal possession and title of certain property to a second party, called a trustee. While that trus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

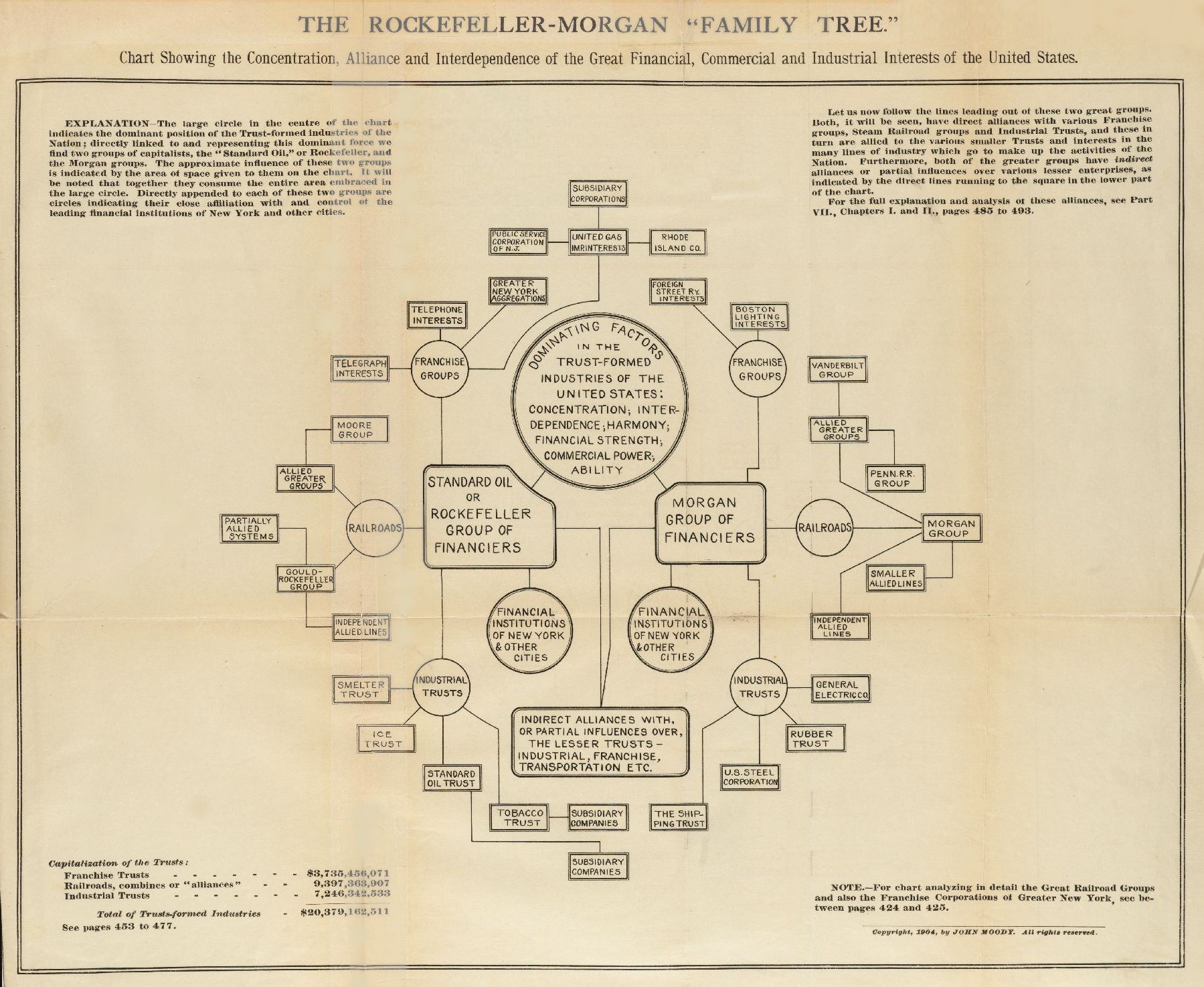

The Rockefeller-Morgan Family Tree, 1904

''The'' () is a grammatical article in English, denoting persons or things already mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with pronouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant sound, and as (homophone of pronoun '' thee'') when followed by a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Anti-competitive Practices

Anti-competitive practices are business or government practices that prevent or reduce competition in a market. Antitrust laws differ among state and federal laws to ensure businesses do not engage in competitive practices that harm other, usually smaller, businesses or consumers. These laws are formed to promote healthy competition within a free market by limiting the abuse of monopoly power. Competition allows companies to compete in order for products and services to improve; promote innovation; and provide more choices for consumers. In order to obtain greater profits, some large enterprises take advantage of market power to hinder survival of new entrants. Anti-competitive behavior can undermine the efficiency and fairness of the market, leaving consumers with little choice to obtain a reasonable quality of service. Anti-competitive behaviour is used by business and governments to lessen competition within the markets so that monopolies and dominant firms can generate superno ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bell Telephone Company

The Bell Telephone Company, a common law joint stock company, was organized in Boston, Massachusetts, on July 9, 1877, by Alexander Graham Bell's father-in-law Gardiner Greene Hubbard, who also helped organize a sister company – the New England Telephone and Telegraph Company. The Bell Telephone Company was started on the basis of holding "potentially valuable patents", principally Bell's master telephone patent #174465. Upon its inception, the Bell Telephone Company was organized with Hubbard as "trustee", although he was additionally its ''de facto'' president, since he also controlled his daughter's shares by power of attorney, and with Thomas Sanders, its principal financial backer, as treasurer. The two companies merged on February 17, 1879, to form two new entities, the National Bell Telephone Company of Boston, and the International Bell Telephone Company, soon after established by Hubbard and which became headquartered in Brussels, Belgium.Huurdeman, Anton A''The Wo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Motion Picture Patents Company

The Motion Picture Patents Company (MPPC, also known as the Edison Trust), founded in December 1908 and terminated seven years later in 1915 after conflicts within the industry, was a trust of all the major US film companies and local foreign-branches ( Edison, Biograph, Vitagraph, Essanay, Selig Polyscope, Lubin Manufacturing, Kalem Company, Star Film Paris, American Pathé), the leading film distributor ( George Kleine) and the biggest supplier of raw film stock, Eastman Kodak. The MPPC ended the domination of foreign films on US screens, standardized the manner in which films were distributed and exhibited within the US, and improved the quality of US motion pictures by internal competition. But it also discouraged its members' entry into feature film production, and the use of outside financing, both to its members' eventual detriment. Creation The MPPC was preceded by the Edison licensing system, in effect in 1907–1908, on which the MPPC was modeled. During the 1890 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ivar Kreuger

Ivar Kreuger (; 2 March 1880 – 12 March 1932) was a Swedish civil engineer, financier, entrepreneur and industrialist. In 1908, he co-founded the construction company Kreuger & Toll Byggnads AB, which specialized in new building techniques. By aggressive investments and innovative financial instruments, he built a global match and financial empire. Between the two world wars, he negotiated match monopolies with European, Central American and South American governments, and finally controlled between two thirds and three quarters of worldwide match production, becoming known as the "Match King".''Kreuger Genius And Swindler'' by Robert Shaplen (Alfred A. Knopf Inc. New York; 1960, p.9) Kreuger's financial empire has been described by one biographer as a Ponzi scheme, based on the supposedly fantastic profitability of his match monopolies. However, in a Ponzi scheme early investors are paid dividends from their own money or that of subsequent investors. Although Kreuger did thi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Mercantile Marine Company

The International Mercantile Marine Company, originally the International Navigation Company, was a trust formed in the early twentieth century as an attempt by J.P. Morgan to monopolize the shipping trade. IMM was founded by shipping magnates Clement Griscom of the American Line and Red Star Line, Bernard N. Baker of the Atlantic Transport Line, J. Bruce Ismay of the White Star Line, and John Ellerman of the Leyland Line. The Dominion Line was also amalgamated. The project was bankrolled by J.P. Morgan & Co., led by financier J. P. Morgan. The company also had working profit-sharing relationships with the German Hamburg-Amerika and the North German Lloyd lines. The trust caused great concern in the British shipping industry and led directly to the British government's subsidy of the Cunard Line's new ships RMS ''Lusitania'' and RMS ''Mauretania'' in an effort to compete. IMM was a holding company that controlled subsidiary corporations that had their own subsidiaries. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Tobacco Company

The American Tobacco Company was a tobacco company founded in 1890 by J. B. Duke through a merger between a number of U.S. tobacco manufacturers including Allen and Ginter and Goodwin & Company. The company was one of the original 12 members of the Dow Jones Industrial Average in 1896. The American Tobacco Company dominated the industry by acquiring the Lucky Strike Company and over 200 other rival firms. Antitrust action begun in 1907 broke the company into several major companies in 1911. The American Tobacco Company restructured itself in 1969, forming a holding company called American Brands, Inc., which operated American Tobacco as a subsidiary. American Brands acquired a variety of non-tobacco businesses during the 1970s and 1980s and sold its tobacco operations to Brown & Williamson in 1994. American Brands subsequently renamed itself "Fortune Brands". History Origins James Buchanan Duke's entrance into the cigarette industry came about in 1879 when he electe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theodore Roosevelt

Theodore Roosevelt Jr. ( ; October 27, 1858 – January 6, 1919), often referred to as Teddy or by his initials, T. R., was an American politician, statesman, soldier, conservationist, naturalist, historian, and writer who served as the 26th president of the United States from 1901 to 1909. He previously served as the 25th vice president under President William McKinley from March to September 1901 and as the 33rd governor of New York from 1899 to 1900. Assuming the presidency after McKinley's assassination, Roosevelt emerged as a leader of the Republican Party and became a driving force for anti-trust and Progressive policies. A sickly child with debilitating asthma, he overcame his health problems as he grew by embracing a strenuous lifestyle. Roosevelt integrated his exuberant personality and a vast range of interests and achievements into a "cowboy" persona defined by robust masculinity. He was home-schooled and began a lifelong naturalist avocation before attendi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Industrial Commission

{{Distinguish, Industrial Relations Commission The Industrial Commission was a United States government body in existence from 1898 to 1902. It was appointed by President William McKinley to investigate railroad pricing policy, industrial concentration, and the impact of immigration on labor markets, and make recommendations to the President and Congress. McKinley and the Commissioners launched the trust-busting era. The Industrial Commission included McKinley's Ohio running mate, Commissioner Andrew L. Harris (a Governor of Ohio and Civil War General) who served as Chair of the Agriculture Subcommittee, and prominent Senators and Congressmen. After McKinley was assassinated in 1901, President Theodore Roosevelt heeded the advice of the Commissioners and further regulated the large trusts. Roosevelt became known as the nation's toughest trust-buster. See also * Commission on Industrial Relations The Commission on Industrial Relations (also known as the Walsh Commission) p. 12 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust-busting

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust law (or just antitrust), anti-monopoly law, and trade practices law. The history of competition law reaches back to the Roman Empire. The business practices of market traders, guilds and governments have always been subject to scrutiny, and sometimes severe sanctions. Since the 20th century, competition law has become global. The two largest and most influential systems of competition regulation are United States antitrust law and European Union competition law. National and regional competition authorities across the world have formed international support and enforcement networks. Modern competition law has historically evolved on a national level to promote and maintain fair competition in markets principally within the territorial boun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William McKinley

William McKinley (January 29, 1843September 14, 1901) was the 25th president of the United States, serving from 1897 until his assassination in 1901. As a politician he led a realignment that made his Republican Party largely dominant in the industrial states and nationwide until the 1930s. He presided over victory in the Spanish–American War of 1898; gained control of Hawaii, Puerto Rico, the Philippines and Cuba; restored prosperity after a deep depression; rejected the inflationary monetary policy of free silver, keeping the nation on the gold standard; and raised protective tariffs to boost American industry and keep wages high. A Republican, McKinley was the last president to have served in the American Civil War; he was the only one to begin his service as an enlisted man, and end as a brevet major. After the war, he settled in Canton, Ohio, where he practiced law and married Ida Saxton. In 1876, McKinley was elected to Congress, where he became the Republ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Holding Company

A holding company is a company whose primary business is holding a controlling interest in the securities of other companies. A holding company usually does not produce goods or services itself. Its purpose is to own shares of other companies to form a corporate group. In some jurisdictions around the world, holding companies are called parent companies, which, besides holding stock in other companies, can conduct trade and other business activities themselves. Holding companies reduce risk for the shareholders, and can permit the ownership and control of a number of different companies. ''The New York Times'' also refers to the term as ''parent holding company.'' Holding companies are also created to hold assets such as intellectual property or trade secrets, that are protected from the operating company. That creates a smaller risk when it comes to litigation. In the United States, 80% of stock, in voting and value, must be owned before tax consolidation benefits such ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)